Avoiding Customs Clearance Delays & Issues

Importing globally? Customs can take a long time to learn, so this guide isn’t intended to turn you into a customs expert. What it will do is make you into a more empowered and informed importer so that you will know the right questions to ask and how to ask them when you’re speaking to your supplier, customs broker, or logistics provider.

From origin to destination, all importers face a common barrier: customs clearance. This is what you need to know about getting your products from A to B, smoothly and with lower costs.

Calculate the Cost of Your Clearance

Calculate the cost of your customs clearance hassle-free! Here’s a simple and efficient method to estimate all associated expenses, including duties and fees, when importing goods.

Do I need a Customs Broker?

Customs brokers are licensed through CBP to act as agents on behalf of importers. They may be independent or may also operate as a freight forwarder.

From a CBP perspective, customs brokers facilitate shipments on behalf of importers coming into and through the United States and ensure that goods are declared properly when they’re coming into the country. Customs brokers also make sure that there’s no contraband in the shipments.

From a business perspective, customs brokers assist importers in getting their freight into the US as quickly and smoothly as possible. A skilled broker will help lower the cost of duties and taxes while sticking to the rules.

So, while you don’t need to use a customs broker, they can really help navigate the shipping process and help you avoid unnecessary costs and delays.

Looking for live quotes from vetted providers?

Customs Clearance Entry and Duties

A customs entry is a required official document for any commercial shipment entering the US. An entry form will contain the following information:

- Country of origin

- Description of imported goods

- Cost, insurance and freight (CIF) value

- HS code

- Expected duties

Depending on the value of the goods being imported, every shipment will have either a formal, informal, or will fall below the de minimis threshold.

- Formal entries apply to the import of commercial shipments valued at $2,500 or more.

- Informal entries apply to the import of commercial or personal items valued at less than $2,500.

- Section 321 or de minimis shipments contain parcel packages valued below the $800 customs threshold. These shipments are exempt from duties and taxes.

In addition to filing the correct entry documents spending on the value of the goods being shipped, importers must prepare an ISF (Imported Security Filing) on all ocean cargo coming into the US prior to cargo leaving origin.

AD/CVD, or Anti-Dumping & Countervailing Duties, apply to imported products that are considered to be unfairly subsidized or priced below fair market value. This tariff essentially levels the playing field to protect local industry.

How to do Customs Clearance Right

If you are using a customs broker, you will need to sign a Power of Attorney in order for them to work on your behalf as an importer.

For formal entries and all containerized ocean imports, importers are required to issue surety bonds against the duties owed.

- A Single Bond is taken out on each individual shipment. This can be time consuming if you are importing more frequently. In this case it is simpler to have a continuous bond.

- A Continuous Bond is automatically renewed and covers bonds on all shipments for a calendar year.

Customs clearance will entail other forms and documents. In fact, there is such a wide and varied range of required documents to prepare when you are importing that it is well worth taking some time to find out what you need and ask your freight forwarder or customs broker any questions that you might have.

Here are some of the required documents you will likely need to prepare when importing goods into the US:

- Shipping documentation (Bill of Lading)

- Commercial invoice

- Packing list

- Arrival notice

- Special documentation

Missing or incomplete documentation is a major source of delay and added cost, so keep on top of your documentation and customs requirements to streamline the process even before goods reach the US. This is really where customs brokers can help you. With their expertise, brokers can help you do customs clearance right and therefore reduce overall times and costs when sourcing goods.

Common Customs Clearance Issues

As we’ve seen, there are a lot of different regulations and documents that importers need in order to get their goods from A to B. With all of this complexity, sometimes things get overlooked.

Here are six common customs clearance issues that importers face:

1. Customs Classification

It’s important to know your HS codes to ensure that you are importing goods with the right classification. If it’s a new type of good, for example, you may need to do some research to find the right designation.

CBP can levy punitive duties if you misclassify your goods, so if you are unsure about the HS codes that apply to the goods you are importing, consider retaining a customs broker. Customs brokers can help you understand how your goods are classified before importing them into the US and ensure they are correctly classified in documentation to avoid expensive penalties and delays.

Find HS codes quickly with HS Code Lookup

2. AD/CVD Compliance

Anti Dumping and Countervailing Duties are instituted by American regulators to level the playing field on subsidized goods or goods priced below market value. For example, the US levies tariffs on Chinese government subsidized steel to maintain market stability and prevent distortion.

In another example, the import of mattresses from a number of countries, including Vietnam, Cambodia, and Thailand, are subject to anti-dumping tariffs to protect the market share of American producers.

Misclassification penalties for AD/CVD are quite stiff so it’s important to double check whether your goods are AD/CVD compliant.

3. PGA Compliance

Partner government agencies regulate the import of goods that may be of concern to the health and safety of American consumers and require additional licensing on certain imports. These agencies include:

- Animal and Plant Health Inspection Service (APHIS)

- Bureau of Alcohol, Tobacco, and Firearms (ATF)

- Federal Drug Administration (FDA)

- Environmental Protection Agency (EPA)

Compliance to PGA licensing and regulation is essential for importers since all imports must be signed off on by both customs and by PGAs.

4. IPR (intellectual property rights)

If you are importing goods that have logos or trademarks then you must provide commercial licensing documentation showing that your supplier can legally use those logos and trademarks.

If your goods aren’t permitted into the US because of IP violations, they will either be seized and destroyed OR you will be required to return the goods. You will assume all of the costs of return or destruction and non compliance is heavily penalized.

5. Labeling and Packaging Compliance

Labeling

- Make sure goods are labelled clearly and in English.

- You may be required to include specific labeling based on the type of goods, for example PPE-related or medical products require specific labeling. Other products require clear directions for use, licensing information, or best by date.

Packaging

Most carton shipments are built on pallets at origin because

- It’s cheaper to palletize your shipments at origin when you’re importing into the US.

- It’s easier to handle palletized freight because shipping loose cartons can lead to loss or damage to products.

- The type of pallet you use is important for customs clearance, so before having your products palletized make sure it’s being done right. The US allows plastic or heat-treated and ISPM-15 certified wood pallets (because fungus found on wood can impact the American forestry industry). Non-compliance will result in the product being shipped back and you will have to assume the costs.

6. Record Keeping

What documents do you need to maintain? ALL of them for at least 5 years. AD/CVD is often required to be held for far longer. Failure to produce documents on imports may be subject to fines, duties, and penalties, so keep your records on file and organized.

Customs Violations, Penalties & Costs

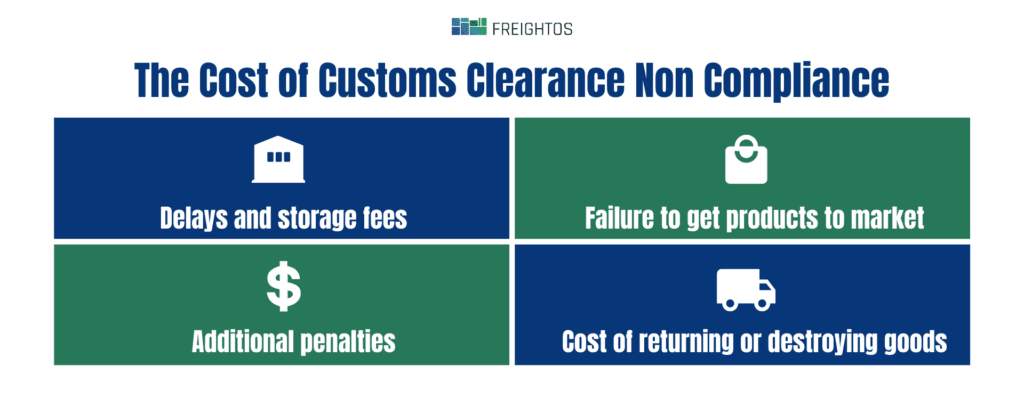

The cost of non compliance increases depending on severity—from negligence to gross negligence to deliberate fraud—and depends on whether the goods are subject to duties or not. Aside from the obvious penalties, there are additional costs to non compliance:

- Delays and storage fees

- Failure to get your products to market

- Additional penalties

- Cost of returning or destroying goods

Avoid Customs Clearance Failures Shipping With Freightos.com

Customs clearance can be complicated and failure to meet all of CBP’s requirements can be costly both in terms of delays and penalties. One way to make sure you are keeping on top of your customs and duties obligations is to work with a customs broker. Freightos makes shipping smooth by offering the option to include customs clearance in your Quote so you can rest easy.

You can also get an idea of what you’ll need to pay in import duties using our convenient Duties Estimator: