What Goes Up, Must Come Down

Since early 2020, the supply chain ramifications of COVID have been a rollercoaster for businesses of all shapes and sizes. Take Conner, the manufacturer of FORT, a magnetic pillow fort. His Kickstarter campaign launched in January of 2021 and raised over $3 million dollars.

But then global freight kicked in.

Here’s what Connor told us last year:

Pretty quickly we realized our costs were going to be about 30% higher than we thought– but we thought, it’s not the end of the world. It’s something that you can overcome. We were pretty confident that we could raise a little bit more money or sell more product. A 30% raise in costs wasn’t going to totally kill us. It really got tricky when we had over thousands of units in production and were starting to book freight and suddenly realized that the cost of freight was almost 4 or 5X what we had budgeted. Then we had to scramble to figure that out because we could only fit a few hundred units in a container and a container cost around $20,000- $25,000.

You can hear the full interview with Conor in our podcast series, Ship Happens.

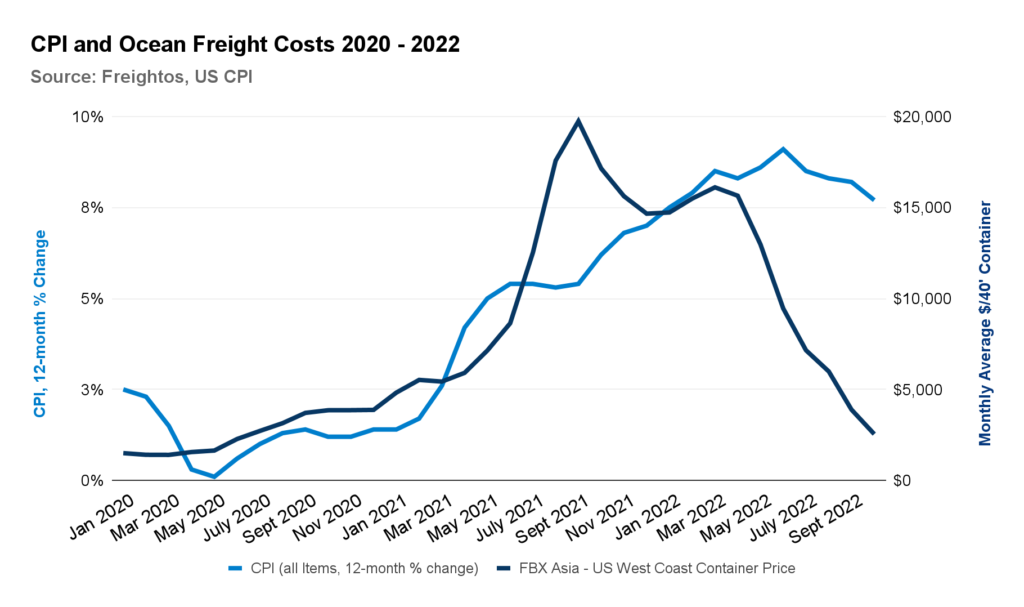

Supply chain challenges continued over the next few years. In late 2020 and throughout 2021, a marked increase in consumption of goods, combined with a perfect storm of shutdowns, congestion, natural disasters and even the Suez Canal getting blocked saw freight prices climb to uncharted heights.

Between September 2019 and September 2021, the cost of shipping a 40’ container from China to the US West Coast had increased from $1,500 to $20,586. Door-to-door costs were even more significant. The cost to ship a similar container from key manufacturing centers in China to Amazon FBA centers in the US reached nearly $26,000. And even when businesses paid the heavy price, congestion – sometimes up to 100 vessels waiting to unload outside of ports in the United States – resulted in door-to-door shipping times that grew from 50 days to nearly 100.

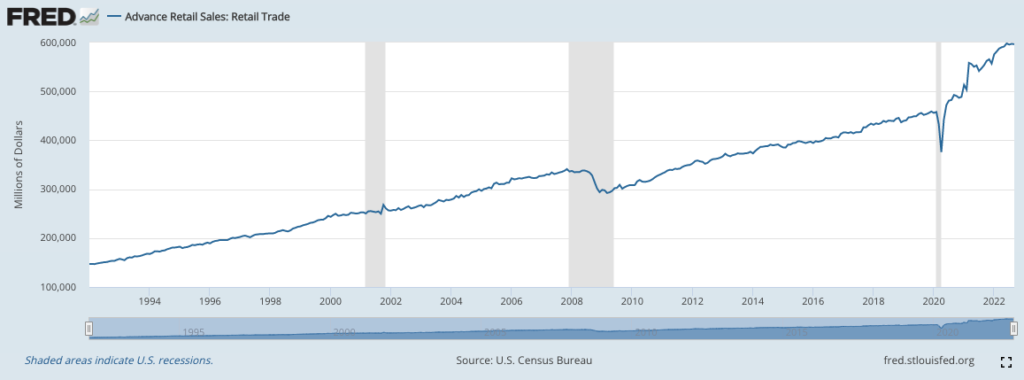

However, through all the supply chain headaches, the one bright spot was consistently soaring customer demand – even though such high demand was a major factor in causing the headaches. After bottoming out in April 2020, retail sales went on a tear. By the time they peaked in June 2022, they were over 30% higher than pre-COVID.

In other words, supply chain snarls were – in many cases – balanced by a dramatic increase in sales. Provided, that is, that the businesses could manage to manufacture and import their goods.

Dropping Rates and the COVID Ripple

Today, in Q4 of 2022, supply chain issues stemming from COVID-related shipping challenges have eased. Ocean rates have come crashing down by some 80% since the end of April. Transit times have also decreased from 100 days to a more tempered 70 days.

And although we’ve become used to the unexpected in global shipping these past few years, the extent to which ocean rates have dropped is striking. Rates continued their downward trend all the way through October, essentially skipping what is usually peak season.

The price drop is not all good news for importers and exporters. That’s because it’s at least partially due to decreased customer demand. And this leaves importers and exporters in a tight spot.

How Businesses have been Dealing with the Effects of COVID – So Far

In a survey of over 1,200 small and medium-sized businesses, Freightos’ research team explored how businesses are experiencing the post-COVID(ish) era. The results tell a mixed story.

While two-thirds of importers said that sales volumes were equal or higher to those in 2019, a full 46% reported spending over 10% of their operating budget on logistics. Prior to the pandemic, only 26% who spent that much on logistics. In other words, sales volumes may be stable or slightly higher…but logistics costs are still dramatically higher.

Over the past two years, businesses typically compensated for the higher supply chain costs by lowering margins (52%) and increasing costs they pass on to consumers (64%). In other words, everyone has been paying for the global supply chain challenges. As a result, a full 87% of importers saw their bottom lines negatively impacted.

But while demand persisted, the challenges did not seem insurmountable. With the dropping demand that’s helped drop freight prices, businesses face a new kind of precariousness.

It’s suddenly about the economy

The biggest change today isn’t supply chain snarls. It’s the fear of disappearing customer appetite. Over half of small businesses (51%) now rank dropping consumer demand as their biggest concern, compared to a third that are concerned about lacking inventory.

More than anything else, this demonstrates a looming sense of uncertainty. A significant number of businesses are concerned about being unable to meet demand, but an even larger number are concerned about disappearing demand.

As we’ve seen in previous Freightos surveys, smaller businesses have been hit harder than larger businesses. For example, 28% of small businesses said that they believe their profitability will take a hit from reduced demand, compared to 16% for midsize businesses. Midsize businesses also continued to report stronger sales compared to 2019 (50%), whereas only 16% of their smaller counterparts said that sales remained strong.

So what does it mean?

This data is interesting but how should it impact decision-making for businesses that import or export? Here’s four to start with:

- Shifting focus: In 2021, the key problem to solve was sourcing and supply chain management. While we (unfortunately) can’t predict the future, it seems fairly safe to say that importers and exporters can finally spend less time finding creative logistics solutions. The trend of dropping rates and fewer congested ports is likely to continue. This means businesses can reduce time spent on securing freight solutions (ideally with freightos.com’s cargo booking platform) and can now focus on what may be a far bigger headache – boosting customer acquisition.

- Cost savings for customers: Since companies can now reduce logistics spend somewhat, those savings can be passed on to customers. This may be particularly valuable to encourage sales as customers tighten their belts due to inflation.

- Avoid the bullwhip effect: Supply chains have been affected by the bullwhip effect over the past few years. What’s the bullwhip effect? In short, it’s when lagging reporting and sourcing time leads to constantly widening surpluses or gaps in inventory. This has impacted every business, from Fortune 100s and down. In order to break the vicious cycle, businesses would be wise to not bank on demand continuing to plummet. It is wide to consider slimming down inventory stocks…but only to an extent. One case for not going too far on reducing inventory is the fact that lower import costs should make building stocks more affordable.

- Source strategically: One explanation why midsize businesses have experienced less volatility than small businesses may be that relationships with logistics providers enable more supply chain stability. Businesses of all sizes can prioritize finding the right manufacturers and logistics platforms right now, when supply chains have stabilized. As a result, relationships built now will persist if (or when) volatility does return, whether due to climate factors, political instability, or other unpredictable factors.

- Implement new features to the existing projects, using PHP, HTML/CSS, JavaScript, MySQL …

- Maintain the web application (refactoring, improving performance, fixing issues, migrating code to new solutions)

- Refactor the software to meet modern standards: SOLID, DDD, Hexagonal Architecture, Unit Test, etc…

- Work on code optimization.

- Work in a cross-functional agile team