This contributed article by Erik Hofmann, Chair of Logistics Management, University of St.Gallen and Florin Osterwalder, Lampe & Schwartze Marine Underwriting, Bremen is based on their recently published research paper.

3PLs provide a wide range of logistics services and have become core players in the logistics industry. In recent years they have increasingly been confronted with digital disruptions such as new business models and technologies.

Against this background, we investigated the influences that digitalization is having on their business models and identified the most likely threats and opportunities for 3PLs in the digital age.

The Methodology That Got Results

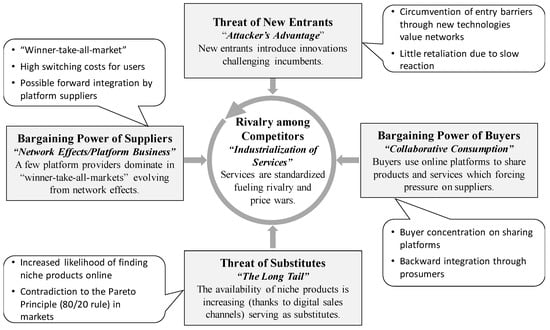

We developed a framework for analyzing digital disruptions in service industries by linking Porter`s five forces (a model that helps determine an industry’s weaknesses and strengths) to theories from research on digitalization and innovation. The framework was then applied on the 3PL industry by analyzing practical examples for each force-theory combination (see Figure 1).

Threats In The Digital Age

Force 1: The Threat Of New Entrants

The threat of new entrants can be explained by the attackers` advantage. Firms that bring new technologies to markets have an advantage to which incumbents must react. In logistics, new transportation technologies such as drones and autonomous vehicles are currently popping up. The e-commerce start-up Siroop, for example, has recently started a drone delivery service in the city of Zurich. Another example is the logistics platform Uber Freight, which is developing own autonomous trucks.

Force 2: The Bargaining Power Of Suppliers

The bargaining power of suppliers is fostered by network effects, helping online platform providers build up significant market power. Online marketplaces like Uber Freight is an example. They serve as an intermediary between shippers and logistics service providers. At the same time, telematics platforms of vehicle manufacturers such as Volkswagen`s Rio aim at providing comprehensive logistics management solutions. By gaining market power and industry knowledge, platform providers have the potential to integrate forward into the 3PL industry.

Force 3: The Bargaining Power Of Buyers

On the buyer side the concept of sharing enables customers of logistics services to bundle their forces. Available transport capacities can be shared through LTL services of platforms such as Cargomatic. Also, start-ups such as Deliv, promote home deliveries from shopping malls by gig-economy drivers. In consequence, customers of logistics services become “prosumers” and compete with 3PLs.

Force 4: The Threat Of Substitutes

The threat of substitutes is intensified through the long tail effect. New niche services sold via the internet make up an increasing proportion of sales. In logistics, this may lead to the substitution of current services. Technologies such as 3D printing are likely to render traditional logistics superfluous. Also, current services may be replaced by niche services better match some customers’ requirements. The start-up Fairtransport, for example, provides emission free carriage for environmentally conscious shippers.

Force 5: Rivalry Among Competitors

Finally, the industrialization of services explains the increasing rivalry among competitors. Like manufactured products, services can also be split into their assembled components. In logistics, services such as transportation and warehousing are standardized and can be carried out by any provider. At the same time, non-physical services such as tracking or order processing can easily be copied by competitors due to standardized IT software modules.

In summary, our analysis shows that digitalization builds up a new competitive arena, as 3PLs face digital hardship from all sides. We identified three digital core threats:

- 3PLs focusing on basic services such as transportation and warehousing may lose market share to new technologies and customized service solutions.

- Online logistics platforms may replace management-related 3PL services. In consequence, 3PLs are likely to become “simple” forwarders.

- There is a simultaneous threat of forward integration by platform providers such as Uber Freight and backward integration by e-commerce companies such as Siroop (or Amazon), as they develop their own logistics solutions.

Opportunities In The Digital Age

Besides the identification of threats, the framework also serves as starting point for the elaboration of digital opportunities. Starting from the framework center, the service industrialization is the “root of problems”. Consequently, 3PLs have to customize services and reduce costs by making use of the mechanisms behind the other four force-theory combinations.

New Technologies

The threat of new entrants can be countered by involving 3PLs in the development of new logistics technologies such as the physical internet. The physical internet is a new, connected logistics system with modular containers, which enables seamless asset sharing and flow consolidation.

New Ways To Build Networks

3PLs can generate network effects through cloud computing. The Logistics Mall, for example, combines logistics services from different providers to create superior customized services.

Harnessing The Sharing Economy

As regards sharing economy, 3PLs can use online platforms to share their logistics infrastructure, assets, and services. This allows to increase capacity utilization and expand service scopes without larger investments.

Incorporating 3D Printing

Finally, as suggested by the research department of DHL, 3PLs can also incorporate 3D printing into their business models. Warehouses can be converted into printing centers from which parts are delivered to customers. Another possibility is to fit 3D printers on trucks and print out ordered parts underway or on site.

For now, it’s not clear which path of these paths is the right one to follow. However choosing none of them, digital inactivity, would be the worst choice for 3PLs. They should already be taking proactive measures towards become digital game changers themselves.