Weekly highlights

A recent survey of SMB importers on the Freightos.com marketplace reflect recent reports of growing retail inventories and dipping demand:

- More than half of respondents report they’ve placed peak season orders early in the hopes of building inventory.

- Two-thirds said they are already experiencing a decrease in demand, with 84% of those attributing that dip to inflation.

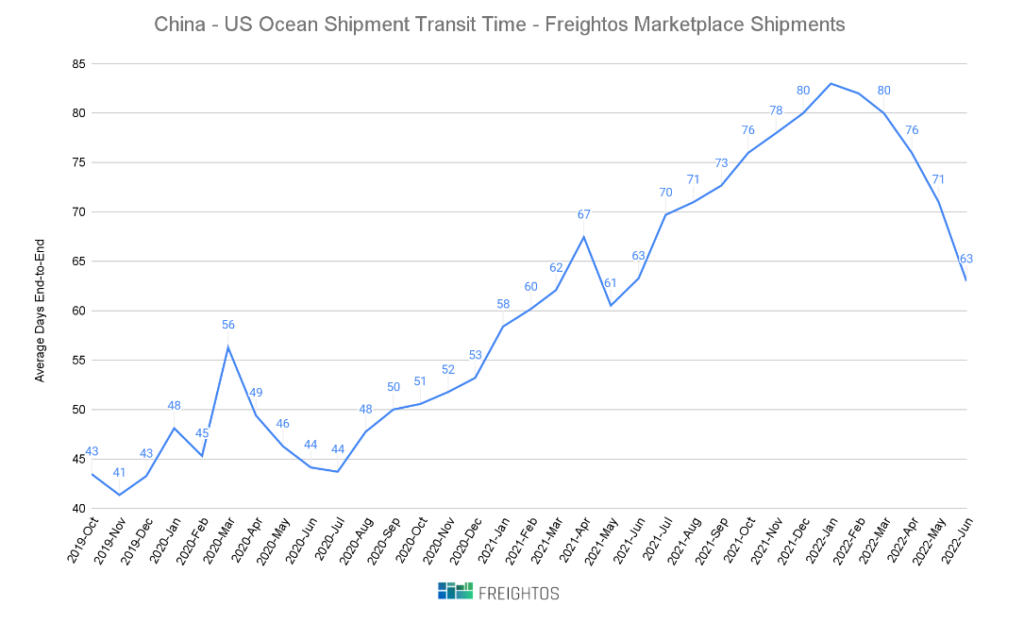

In market news, congestion continues to ease at LA/Long Beach, with Freightos.com China – US ocean transit times down 25% since the start of the year, and level with a year ago.

Transpacific ocean rates have fallen this month unlike in June 2021 when they were climbing with the start of peak season.

This dip could be attributed to a number of factors: relative improvements in container flows, volumes still to come as Shanghai rebounds, or a decrease in underlying demand. Regardless of the reason, for now spot rates for many shippers are lower than contract rates.

This trend could add more instability at a time that many carriers and shippers might prefer reliability.

Asia-US rates for this week

- Asia-US West Coast prices (FBX01 Daily) dipped 3% to $8,934/FEU. This rate is just 1% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) fell 1% to $11,589/FEU, and are 16% higher than rates for this week last year.

More rates from Freightos.com

| Containerized Freight Rates from the Freightos Baltic Index | |||||

| FBX Lane | Global | Asia – US West Coast | Asia –US East Coast | Asia – North Europe | North Europe – US East Coast |

| This Week | $7,036 | $8,934 | $11,589 | $10,575 | $8,003 |

| Last Week | -1% | -3% | 1% | 0% | 0% |

| Last Year* | 13% | 1% | 16% | -4% | 54% |