Freight Calculator: Calculate Air & Sea Shipping + Freight Costs

Use our free freight rate calculator to discover international import & export prices instantly with global freight estimates. Try it now!

How to Instantly Calculate Your Freight Costs and Determine Your Freight Rates

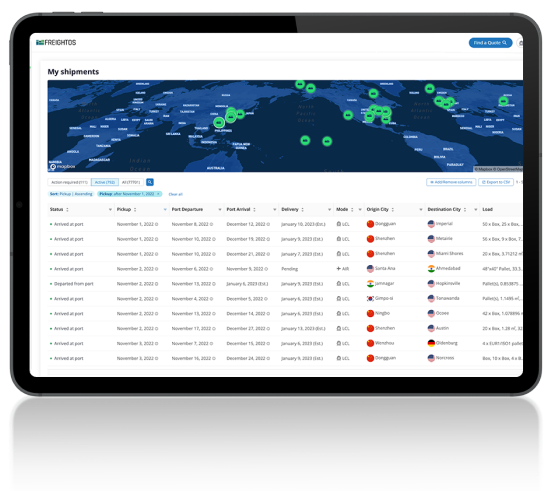

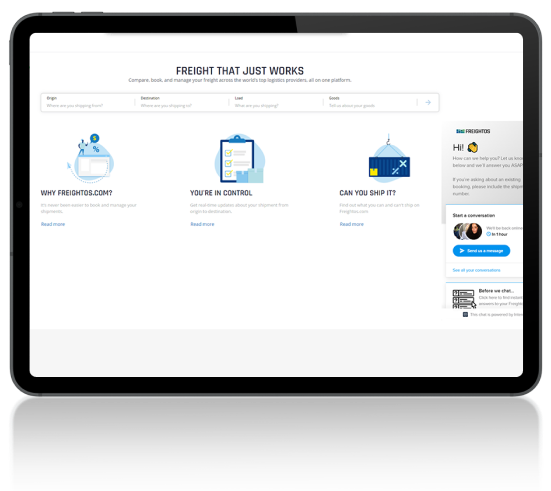

Our free international freight quote calculator delivers accurate freight rate estimates. Just tell us about your shipment to get an estimate from the world’s largest freight rate database. Then join Freightos to compare, book, and manage your upcoming shipments using our freight rate calculator.

Behind the Freight & Shipping Cost Calculator

Over 1.5B+ Data Points

Powered by the Freightos Baltic Index and backed by the Singapore Exchange.

Hundreds of Providers

Based on live freight rates from hundreds of international freight forwarders and carriers.

Reliable Freight Data

Providing instant freight quotes that include costs and surcharges.

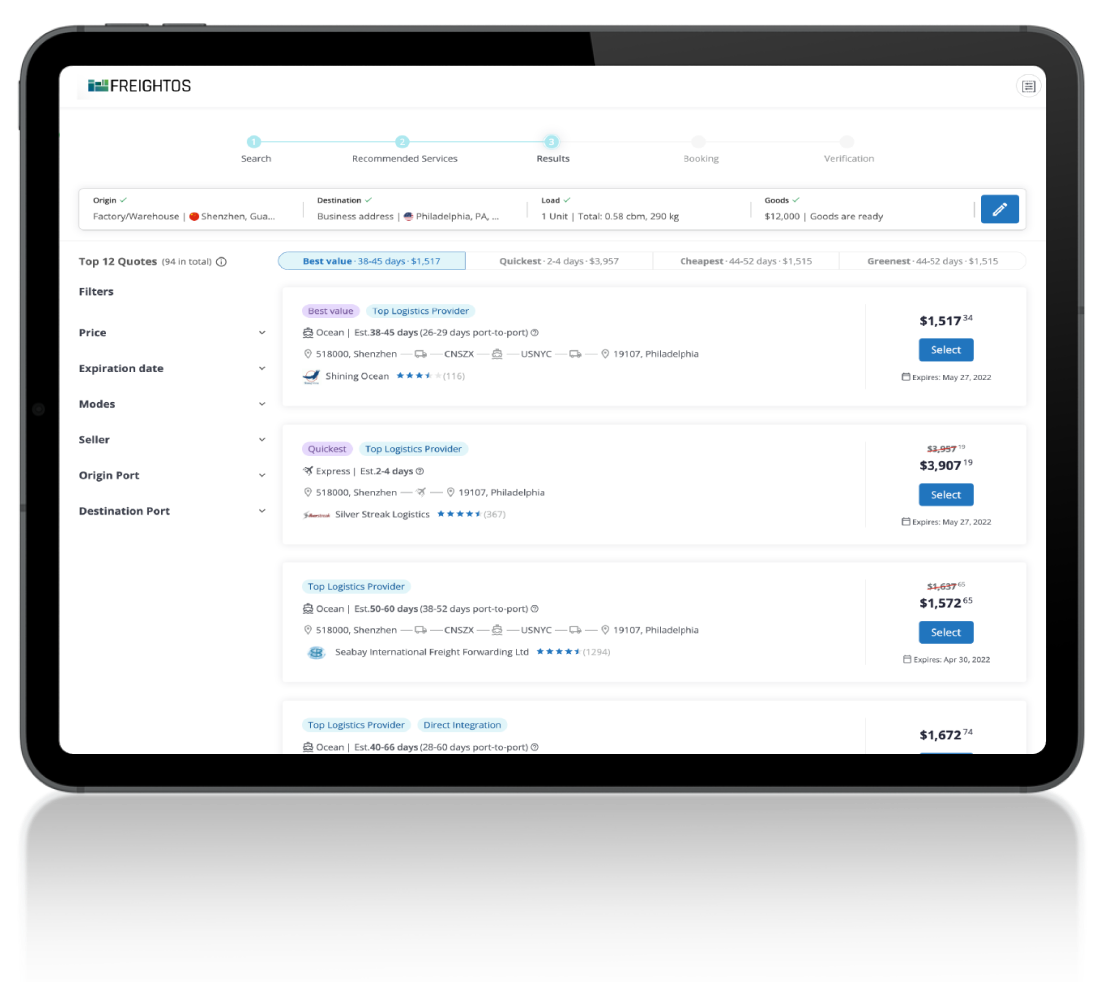

How to Calculate Freight Rates & Shipping Costs With the Freight Calculator

Follow these step-by-step instructions to calculate freight shipping costs using the freight rate calculator.

1. Select whether you are shipping full containers or boxes/pallets.

2. Enter your load dimensions, weight, quantities, origin, and destination.

3. Search!

4. Want to book? Select the “Get live quotes” button.

Ready to Simplify Your Shipping?

Get free quotes and make a booking in a few clicks