Last updated: June 13th, 2023

Freight & shipping costs & delays

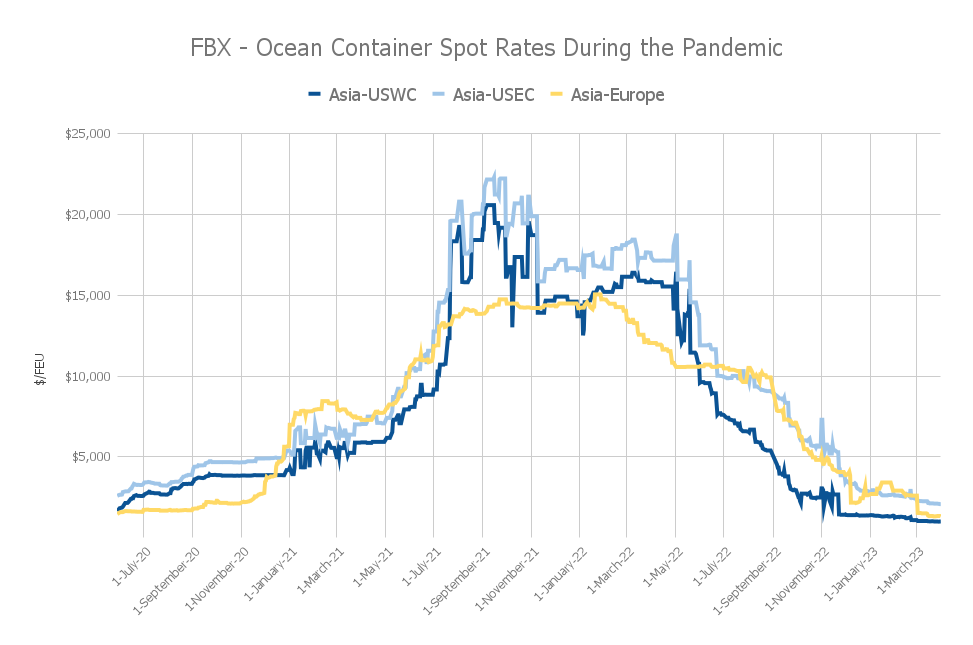

Extremely elevated logistics costs have been one contributor to inflation during the pandemic.

But since the spring of 2022, ocean freight prices have come down, with China-West Coast US rates recently hitting pre-pandemic levels.

Volumes of imported containers to the US continued to fall through November 2022, and congestion eased significantly, especially at LA/Long Beach, where congestion levels returned to normal in late November.

Freightos data shows that rates to ship a 40-ft container from Asia to the US West Coast dropped by more than 80% since the end of April 2022, while prices to the East Coast fell by almost two-thirds. A big driver in falling logistics costs is a drop in consumer spending, which had been responsible for increased sales among many importers over the last two years.

Keep reading for the monthly freight market update for April.

Want updates sent right to your inbox? Sign up for our weekly newsletter here or stay up to date with our weekly freight market update here.

Ocean freight market update & forecast for 2023

According to Freightos data, Asia – Mediterranean ocean rates are now about on par with 2019, though increases in blanked sailings likely mean rates are nearing their floor, as Asia – US East Coast and Asia – Europe prices ticked up last week.

- Asia-US West Coast prices (FBX01 Weekly) decreased 1% to $1,000/FEU. This rate is 94% lower than the same time last year.

- Asia-US East Coast prices (FBX03 Weekly) increased 4% to $2,171/FEU, and are 87% lower than rates for this week last year.

- Asia-N. Europe prices (FBX11 Weekly) increased 6% to $1,427/FEU, and are 88% lower than rates for this week last year.

Asia – Mediterranean ocean prices, which were falling more slowly than Asia-Europe rates for much of this year, decreased by more than 40% since early March and, at about $2,300/FEU, are nearly on par with 2019 prices. Rates for all major tradelanes ex-Asia are likely reaching their floor – with Asia – US East Coast and Asia – Europe rates ticking up last week – as carriers have increased steps to reduce capacity and many transpacific and Asia – Europe ships are now reportedly sailing nearly full.

Transpacific rates continued to fall as well, with West Coast prices below $1,100/FEU – 30% lower than March ‘19 and in fact lower than at any point in 2019.

These are container freight rates for the second week of April 2023 according to the Freightos Baltic Index:

| FBX Lane | Global | Asia – US West Coast | Asia – US East Coast | Asia – North Europe | North Europe – US East Coast |

| This Week | $1,416 | $1,000 | $2,171 | $1,427 | $3,449 |

| Last Week | -4% | -1% | 4% | 6% | -9% |

| Last Year* | -85% | -94% | -87% | -88% | -56% |

| * Compared to the corresponding week in 2022 | |||||

NRF shows March volumes projected to have fallen nearly 30% from a year ago, reflected in transpac rates that were stable last week but about 90% lower than a year ago and well below 2019 levels as well.

Ilwu actions that shut down LA/LB on Thursday night and Friday and slowed operations on Monday – are the sharpest escalation in this dispute so far, and are worrisome and could cause delays and congestion – but the shift of volumes to the EC bc of this threat will mitigate the actual impact of any rise in rates for many importers.

Asia med rates which had remained higher than those on other lanes have fallen and are nearly on par with 2019 levels. Rates are likely reaching their floor as carriers have increased steps to reduce capacity – with reports that ships are sailing on the transpacific and from Asia to Europe nearly full.

Watch the video below to learn what to expect as we move into 2023:

Looking for live quotes from vetted providers?

Freight cost changes from 2020-2023

The past few years have been volatile for shippers around the world. At the beginning of the pandemic, attempts to hedge against dramatic rate drops via capacity management contributed to an increase in prices when consumer demand shot up in the summer of 2020.

Now two years into the supply chain crisis, rates have dropped significantly – although on some lanes prices are still much higher than they were pre-pandemic.

For a bird’s eye view of freight cost increases in 2022 and since the beginning of serious supply chain disruptions, check out the chart below based on FBX data.

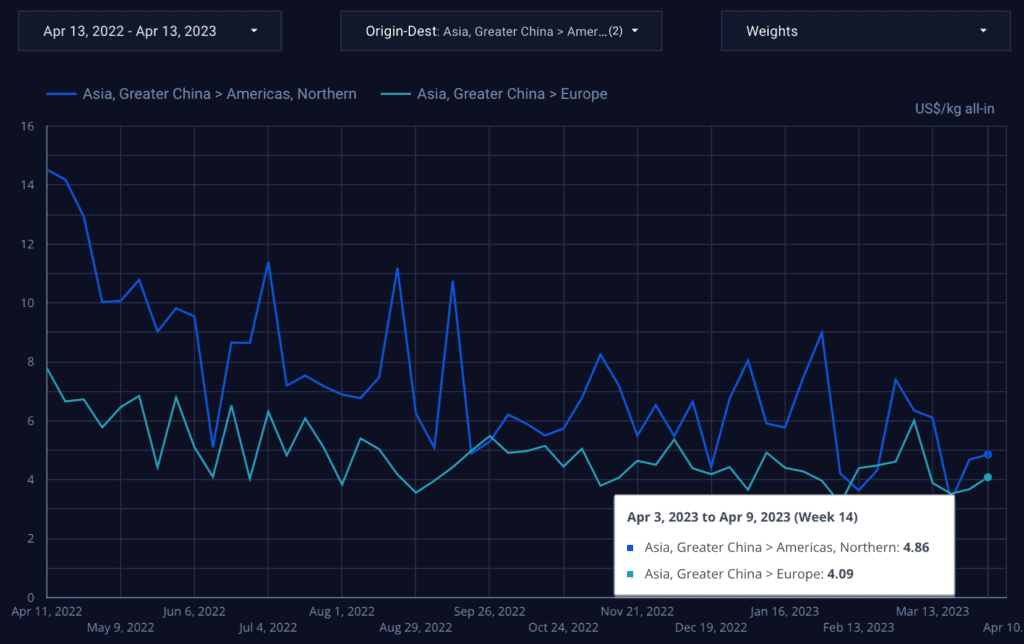

Air freight market update, delays, cost increases, and forecast for 2023

The subdued demand of the past couple of months continued into December reflected in Freightos Air Index rates ex-China to N. America and Europe remained stable compared to November but were about 40% lower than a year ago. Carriers are hoping that – if key economies can avoid serious recessions – demand will recover to more typical levels and seasonality will return in 2023 as inventories normalize.

Looking for live quotes from vetted providers?

Amazon shipping costs in 2023

Keeping up with door-to-door pricing for Amazon FBA shipping can be a hassle. With data from thousands of weekly pricing points from freight forwarders, we’ve developed a weekly index of freight prices including for Less than Container Load (LCL), Full Container Load (FCL), and air cargo, from major export cities in southeast Asia to the most popular Amazon fulfillment centers in the US.

Want to know what the rates are instantly? Check out Freightos.com’s FBAX, the Amazon FBA freight index.

With data from thousands of weekly pricing points from freight forwarders, we’ve developed a weekly index of freight prices including for Less than Container Load (LCL), Full Container Load (FCL), and air cargo, from major export cities in southeast Asia to the most popular Amazon fulfillment centers in the US.

Read up on how Amazon sellers can deal with rapidly-changing consumer demands as well as inventory challenges HERE.

Will shipping prices keep going down?

In the current situation, many importers and exporters are wondering when they can expect freight rates and shipping prices to go level off. The answer? Not yet.

But, despite potential delays and volatile freight shipping costs, there are a few steps importers can take right now:

How to navigate the current freight market:

- Compare at least a few quotes and modes to make sure you are getting the best cost and most efficient service possible.

- Buffer your freight budget and transit time for changes. Costs due to unforeseen delays or limited capacity can arise, so be prepared.

- Explore warehousing options to mitigate the effects of lowered demand and business restrictions in the US.

- Pay attention to the profitability of your goods and consider if a pivot could be worthwhile. Additionally, remember to factor in freight costs when assessing profitability.

How small or midsize importers can plan for operational success on Freightos.com:

- Understand that delays and extra charges may arise. Freight forwarders are trying their best to move goods on schedule without additional fees, but in this unstable period, delays and additional charges can occur out of forwarders’ control.

- Consider which shipping mode is best for you right now. During non-pandemic times, ocean freight is typically far cheaper but has a significant lead time. If your transit time demands it, ship by air and you’ll have confidence in the transit times.

- Book now if you can. Freightos.com is fully operational, so book orders now to get goods moving as quickly as possible.

- Communicate regularly with your freight forwarder. This is more important than ever – staying in touch means you’ll have a better handle on your transit time and stay on top of any changes that may arise.

- Make sure that you have the manpower to accept your goods upon arrival. This will minimize delays.

How to stay informed:

- Keep up to date on the industry with our weekly freight market update.

- Check out our daily FBX ocean rates index to help you stay on top of freight rates in 2023.

As always, we at Freightos.com are here to help. Please reach out if you have any questions or concerns.