The Initial Hurdle: 2021’ Freight Fiasco

During the COVID-19 pandemic, Conor from Fort Toys, like many other entrepreneurs, found himself dealing with skyrocketing demand… and skyrocketing freight costs. His product – a magnetic pillow fort for kids that was funded by a wildly successful Kickstarter campaign – was both fun…and bulky.

This was terrible news for a company now on the hook to ship to kids who were suddenly cooped up and hankering for a fort. As Conor told us in a podcast episode from 2022:

Pretty quickly we realized our costs were going to be about 30% higher than we thought. It’s not the end of the world, it’s something that you can overcome. We were pretty confident that we could raise a little bit more money or sell more product – it was pretty popular.

It really got tricky when we have over thousands of these in production and we’re starting to book freight and we’re realizing that the budget we had put in for freight is… it’s almost 4 or 5X what we had thought it would be.

Source: Fort

Of course, this stark reality was faced by many small and medium-sized businesses (SMBs) during the peak of the pandemic.

The Twist: Falling Costs, Falling Demand

But what goes up must come down.

Here at Freightos, we’ve been tracking sentiment across small and midsize importers as they navigate the wave of COVID and the ensuing ripples. The following data is from a survey we conducted last month (May, 2023) across hundreds of small business importers who tap Freightos.com’s global freight marketplace.

The key takeaway? One challenge appears to have been replaced with another.

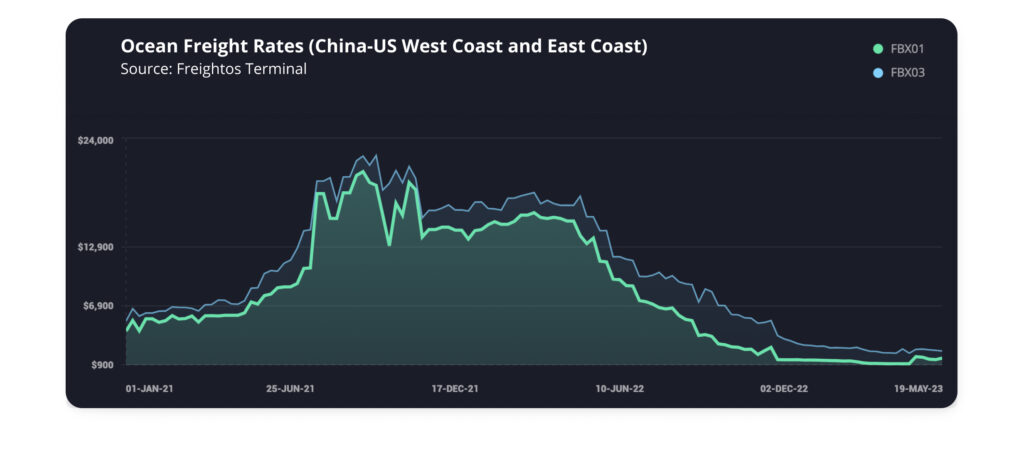

In mid-2022 logistics costs began to recede, dropping almost 90% from May to December according to the Freightos Baltic Index’s China – East Coast (FBX03) and China to West Coast (FBX01). This made supply chain living easier – most (74%) importers report that their logistics operations are at least as smooth as they were pre-pandemic. This is a dramatic improvement from last October, where 87% of importers said that their bottom line was getting hit by supply chain costs.

Yet it was soon to be out of the supply chain pot and into the plummeting demand fire. Businesses quickly began to notice a different beast: a significant decrease in consumer demand compounded by looming inventory excesses.

This trend was a while in coming. By 2023, average inventory turnover for small and midsize businesses, had dropped for the 50% percentile ShipBob seller from 1.59 to 0.85 (Source: ShipBob).

As consumers shifted their spending habits post-pandemic, the resulting behavior formed a formidable economic elephant that importers couldn’t ignore. It was time to adapt.

Yet Another Ecommerce Change

Compared to 50 years ago, the ripple effect from COVID, or the other frequent obstacles importers face, seem far more pronounced. As Nisim Taleb pointed out in Black Swan:

“Today, an earthquake or hurricane commands more and more severe economic consequences than it did in the past because of the interlocking relationships between economic entities …Tokyo’s 1923 earthquake caused a drop of about a third in Japan’s GNP. Extrapolating from the tragedy of Kobe in 1994, we can easily infer that the consequences of another such earthquake in Tokyo would be far costlier than that of its predecessor.”

Small businesses have undergone four or five ecommerce earthquakes over the past few years. Not all of them bad…but many requiring businesses to be retooled, from the rise of eCommerce, to one day shipping, new third party fulfillment options, Shopify and Amazon’s accession, COVID supply chain challenges, and – now – reduced demand.

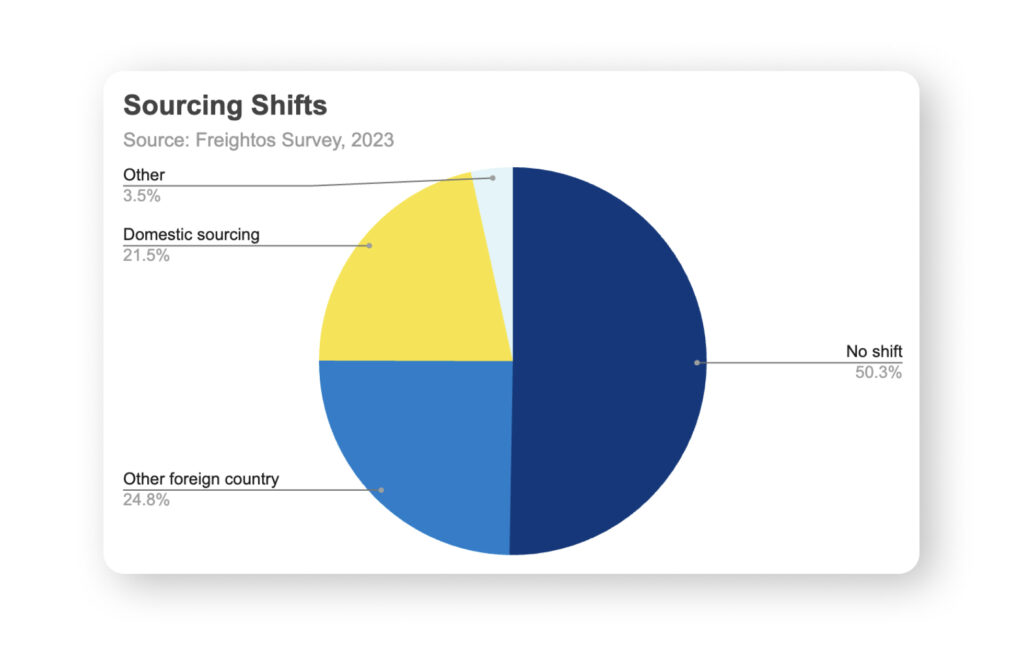

One of the most prominent shifts has been sourcing patterns. Following the COVID import trauma, some 25% of importers are exploring other countries while another 21% are now looking into sourcing domestically.

Overcoming Demand and Inventory Hurdles

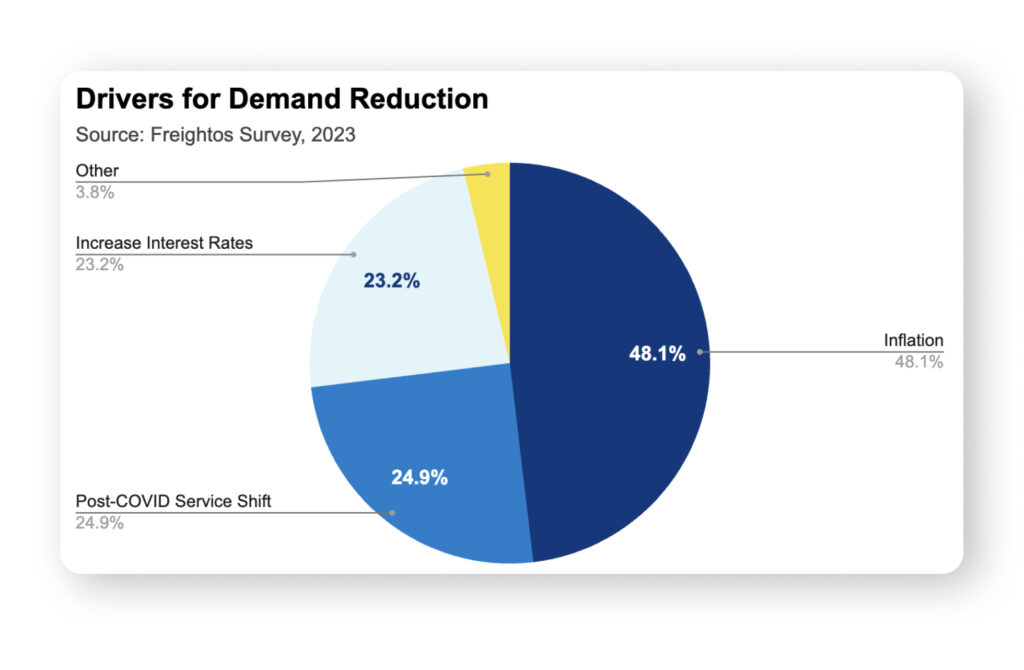

However, regardless of where goods are manufactured, they still need buyers…and these appear to be in short supply. With the majority of SMBs (57%) experiencing a drop in consumer demand over the last year, the struggle is real. Many importers (38%) are pointing fingers at a consumer spending shift to services or a different mix of goods as the pandemic recedes.

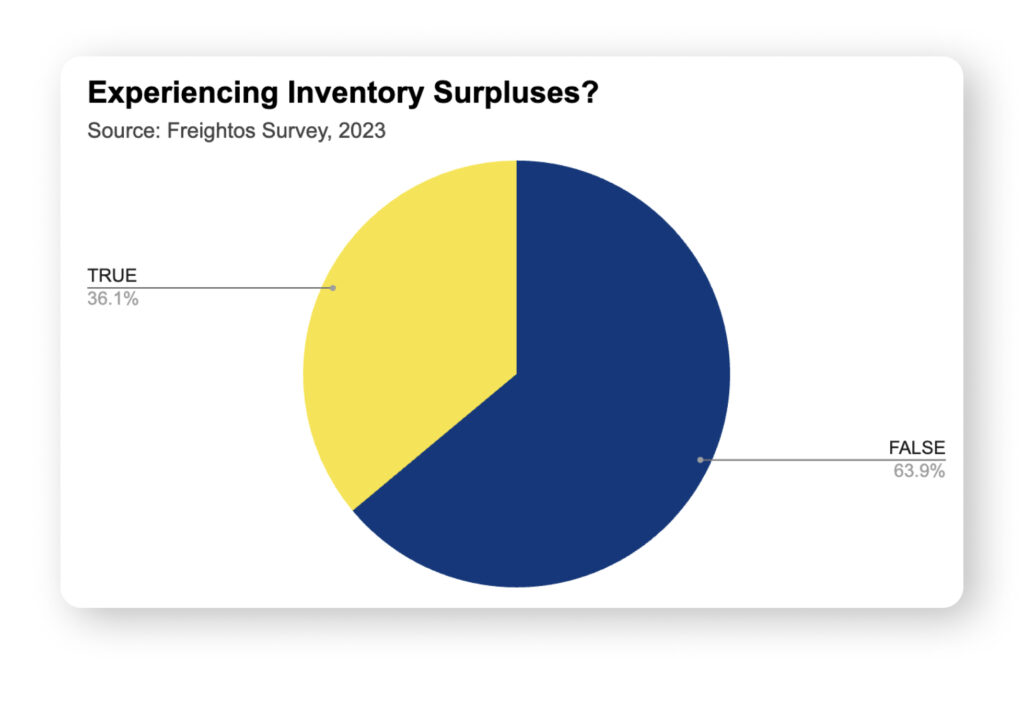

The inventory trend that emerged from ShipBob’s data seems to be extending into 2023. More than a third of small businesses are facing issues with excess inventory.

One silver lining, for consumers at least, is that the drop in logistics is translating into some businesses (26%) lowering their prices, while about 20% report being able to improve their margins through these savings.

Preparing for the Peak Season

If there’s one thing that we’ve learned, it’s that predicting demand is hard. Nearly every company missed how COVID would impact demand (buying way up) or how quickly it would drop off. But it’s still worth asking.

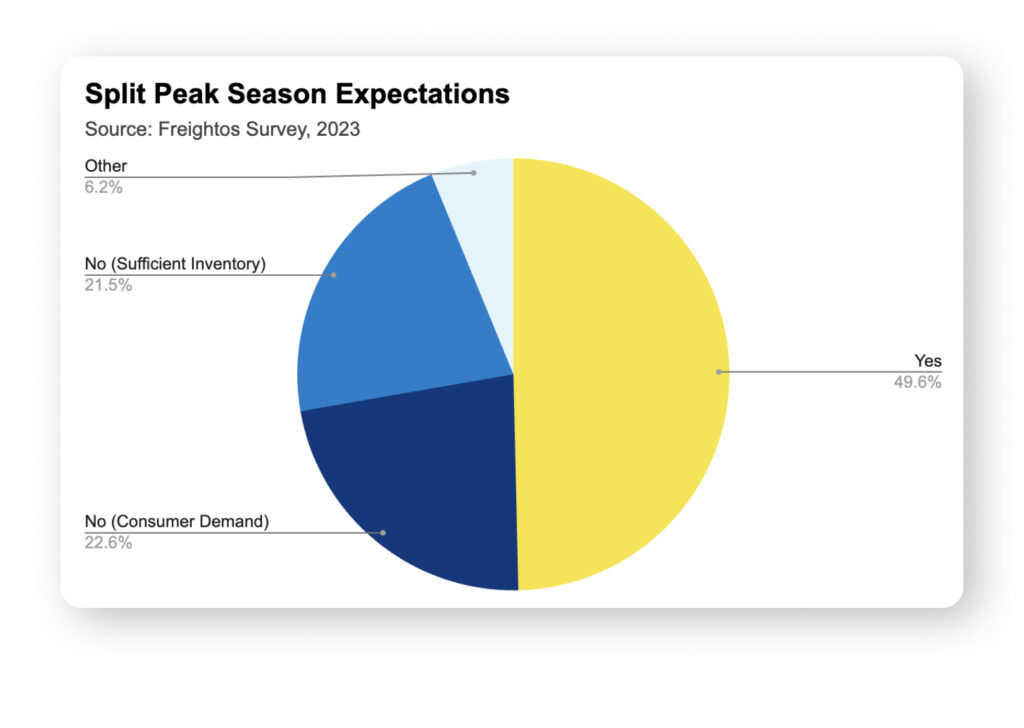

Looking ahead, only about half of the SMBs surveyed anticipate an increase in their importing activity during this year’s peak season (July – October). This could well be the new normal, a hallmark of the post-pandemic economic landscape. But, if you look at the last five years, it’s pretty clear that normal isn’t exactly a term that ever fits for supply chains.

The Road Ahead: Embracing Uncertainty

The post-pandemic journey for small businesses like Fort Toys is looking like a roller coaster ride, filled with unexpected twists and turns. These companies have a strong track record of adapting to new tech, new trends in consumer demand, and new trends in distribution. But while the cost of doing global business – whether sourcing, importing or sales – has normalized, the demand for global business may be a more daunting challenge.