Weekly highlights

All eyes are on Shanghai as the manufacturing hub begins reopening after more than two months of being locked down.

There are initial signs of progress in trucking availability, and the decrease in available exports has pushed Asia – US West Coast rates down to less than $11,000/FEU. This is their lowest level since last July and a more than 30% drop since the start of the lockdown.

Blank sailings are keeping Asia – North Europe prices level. Rates fell just 2% to $10,579/FEU since the end of April, though they have decreased a total of 12% since the start of the lockdown.

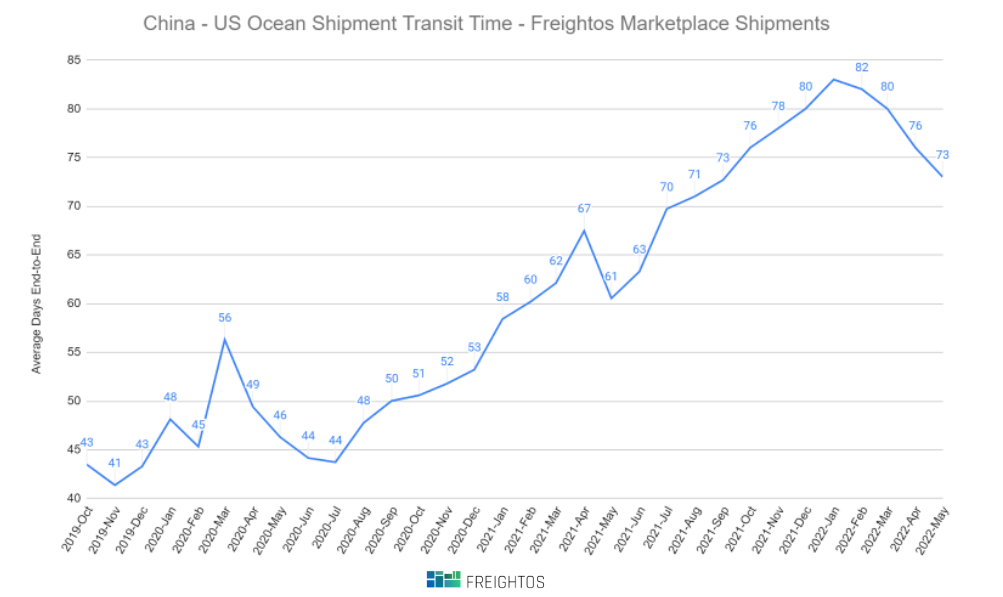

Congestion has gotten worse at EU ports since the lockdown began. Freightos.com data shows transit times from China have fallen 12% since January.

But while port conditions have improved at LA/Long Beach, new rail backups and scarce warehousing are increasing concerns that a surge of containers from Shanghai could erase these gains.

Asia-US rates for this week

- Asia-US West Coast prices (FBX01 Daily) fell 6% to $10,762/FEU. This rate is 33% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) fell 5% to $13,796/FEU, and are 84% higher than rates for this week last year.

More rates from Freightos.com

| Containerized Freight Rates from the Freightos Baltic Index | |||||

| FBX Lane | Global | Asia – US West Coast | Asia –US East Coast | Asia – North Europe | North Europe – US East Coast |

| This Week | $7,622 | $10,762 | $13,796 | $10,579 | $8,395 |

| Last Week | -3% | -6% | -5% | 0% | 0% |

| Last Year* | 41% | 33% | -84% | 0% | 92% |