When it comes to the global freight industry, the one thing that’s been predictable over the past few years is the lack of predictability. Facing one crisis after another – from Trump’s tariffs in 2018 to COVID-19 disruptions beginning in 2020 to resulting demand fluctuations, inflation, and congestion issues continuing through 2023 – the industry has met more than its share of challenges and had to bring resourcefulness and resilience to keeping goods moving around the world.

What’s in store for 2024? Let’s take a closer look at recent events to get a sense of what’s to come.

Looking for freight quotes from vetted providers?

The Houthi attacks on Red Sea vessels present global freight challenges in 2024

As we begin 2024, global freight faces a new challenge: the ongoing Houthi attacks on vessels in the Red Sea.

These attacks, which began in mid-November, initially targeted Israeli-owned vessels. However, they quickly expanded to include vessels with no apparent ties to Israel, posing a broader threat to the shipping industry.

An international force led by the United States was formed in late December to protect vessels navigating this critical waterway. But the force’s warnings, ultimatums, and even attacks on Houthi positions in Yemen have not managed to stop the attacks.

Houthi attacks led to route diversions, which means delays for importers and exporters

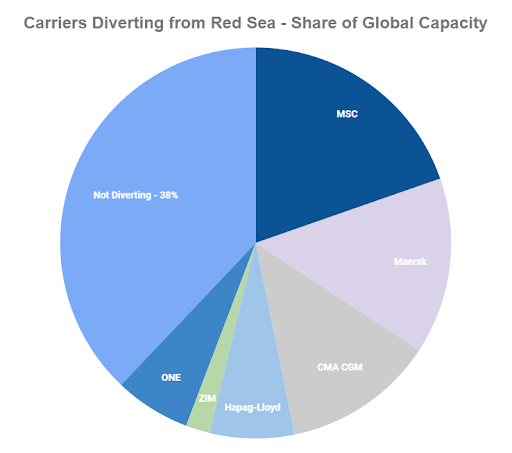

By mid-December, the freight industry was feeling the disruption. Major carriers, seeking to protect their vessels, began diverting containers from the Red Sea, which meant longer routes – and longer routes meant longer transit times and delayed deliveries.

The effect was widespread.

Diversions caused by Red Sea attacks were implemented by carriers representing 60% of the total industry capacity – and millions of twenty-foot equivalent units (TEUs) were rerouted away from the Suez Canal.

The bottom line: diverted routes have seen an increase of 7-14 days in transit time. And the threat of congestion looms.

The snowball effect of route diversions due to Suez Canal attacks

With vessels tied up in longer journeys, available capacity in the market is tightening. Some carriers are responding by adding extra loaders or activating new vessels. However, space is starting to become tight, especially in Asian-origin ports and export hubs and especially ahead of the Lunar New Year holiday in early February.

An additional consequence of longer voyages is the delayed return of empty containers to Asian origin ports, which has resulted in reports of certain container types being unavailable, affecting not only Red Sea lanes but also other lanes out of Asia.

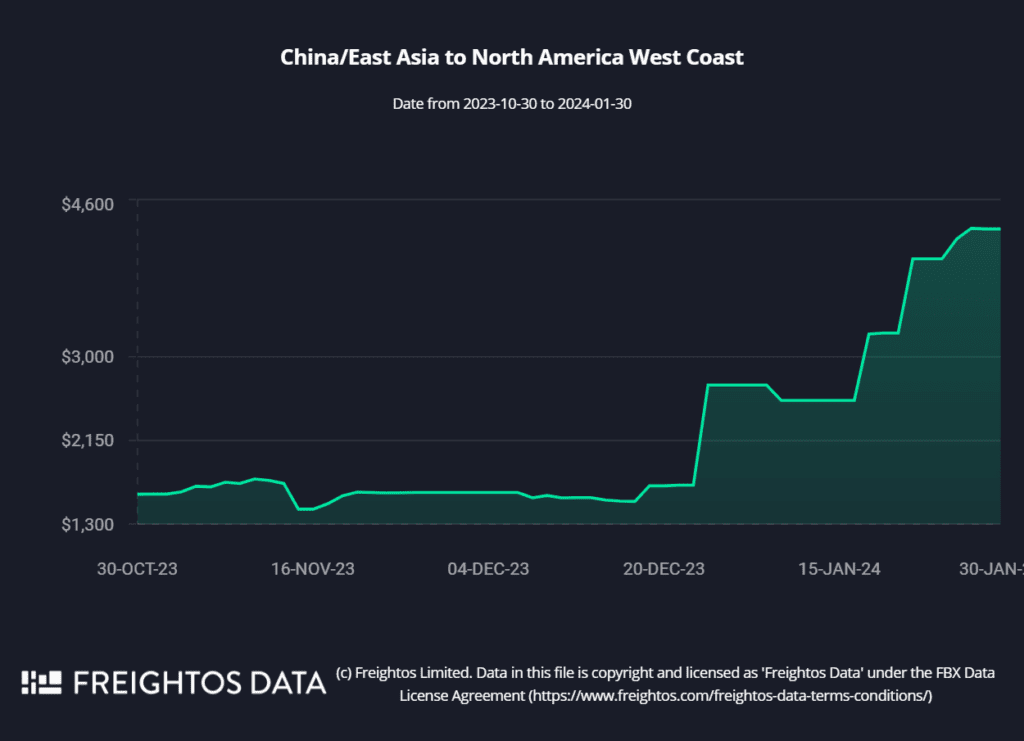

Prices are affected too

You knew this was coming: big disruptions mean prices start to rise.

This is due to GRIs and surcharges that carriers have implemented to address longer voyages, which require more vessels to maintain schedules, resulting in increased expenses for additional fuel and operational costs.

Rates have increased significantly, particularly on routes to North America, Europe, and the Mediterranean.

The ongoing attacks and heightened security concerns have also led to significant increases in insurance premiums for vessels still transiting the Red Sea. Some premiums have risen by as much as 1% of vessel values. This increase in insurance costs makes it more expensive for carriers to continue their transits through the region.

Here’s a look at rates over the past few months:

The disruption is widespread

While container carriers were initially the most affected by diversions, recently diversions have impacted other sectors as well. Gas and oil carriers, bulk carriers, and roll-on, roll-off carriers have all been affected by the shifting dynamics of the freight industry in the wake of the Red Sea situation.

How is the Red Sea Crisis expected to affect shipping in 2024?

While the situation may sound dire, the lessons of the past few years can help keep the Suez situation in proportion as we look ahead to 2024.

It’s important to note that the disruptions caused by the Red Sea situation are not expected to reach the same levels as the pandemic-driven disruptions of recent years. Here are a few reasons why:

Air cargo industry rates are not rising significantly

Unlike during the pandemic, air cargo rates have not seen a significant increase due to the Red Sea situation. Ocean delays and cost increases have not yet shifted significant volumes to air cargo, suggesting that shippers are navigating the challenges without resorting to more expensive alternatives.

Ocean rate increases, while significant, are nowhere near pandemic surge levels

During the peak of COVID-19 rate increases, rates on 40-foot containers from Asia to North Europe and the Mediterranean jumped to about $15,000, while rates from Asia to North America surpassed $20,000.

Rates are currently around three times higher than 2019 levels, but are unlikely to climb much past $8,000.

Pandemic rate surges were driven by massive demand

Remember in 2020 when people started ordering everything they could think of, from toilet paper to exercise equipment to large furniture? Pandemic disruptions were largely driven by an unrelenting surge in demand for goods. The volume of goods people were ordering overwhelmed ports and caused a lot of congestion. This congestion, in turn, tied up capacity as ships waited to unload and return to their origin ports.

In that case, the market had to wait for demand to ease, and backlogs to clear.

This time, congestion and delays are not demand-driven, which means that delays and congestion are not expected to get nearly as bad as they were in 2020-2021.

Carriers were already dealing with vessel overcapacity going into 2024

Before the Suez Canal crisis began, carriers were facing an overcapacity issue – where the demand of a few years ago had led to investment in additional vessels that were then less needed as demand eased.

Now, suddenly there is a need for extra vessels due to the new congestion caused by the crisis.

With this extra capacity, there is a solution to the problems caused by longer voyages, and containers can keep moving, even with longer transit times.

Lunar New Year volumes will soon come to an end

During this time of year, shipping volumes are up as importers and exporters rush to get shipments to their destinations ahead of Lunar New Year celebrations in early-mid February that shut down a lot of manufacturing and logistics.

This increase in demand can extend for a few weeks after the holiday as well as backlogs clear up.

Periods like these add pressure to the Suez disruption, but they are seasonal and temporary.

In the weeks following Lunar New Year, we will likely see an easing of demand, which, together with carriers moving more vessels into place and adjusting schedules in the coming weeks, should ease the effects of the crisis.

One trend is clear: the industry has learned resilience

As the global freight industry faces the uncertainties of 2024, it is clear that the Red Sea situation will continue to play a significant role in shaping the year ahead. While disruptions are expected to persist in some form until traffic resumes through the Red Sea, there is optimism that the situation will stabilize after the Lunar New Year period.

As the industry adjusts to this new reality, one thing remains constant: the resilience and adaptability of the global freight network. Over the past few years, the industry has become more creative and adaptive to change – so the flow of goods will continue, connecting economies and driving global trade forward.