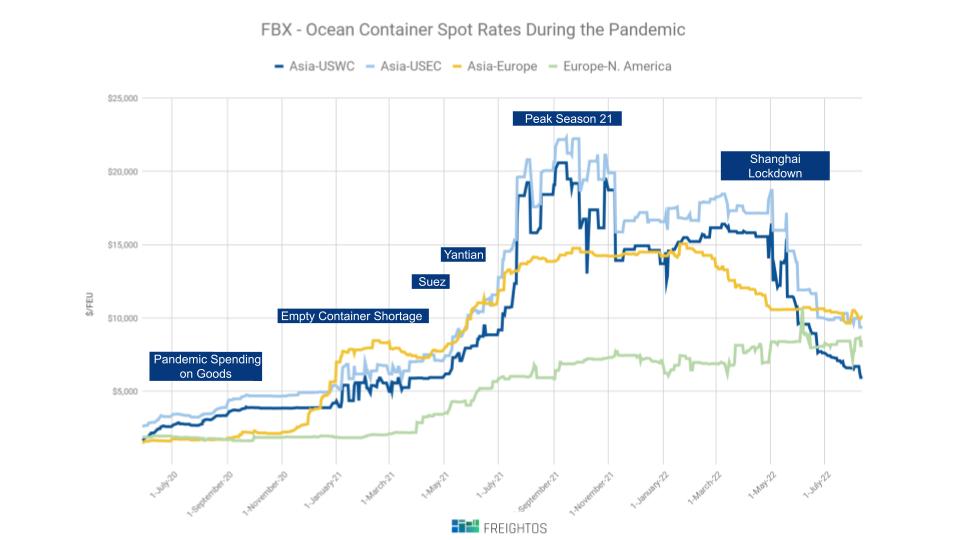

Since the start of the coronavirus pandemic, freight – like so many other areas of life – has been jolted again and again by disruption. Where once the price and transit time of a shipment were largely predictable, volatility has become the name of the game.

That volatility has largely meant continual price increases. But as we move through peak shipping season, prices have actually been decreasing.

What’s going on?

Continue reading for data-based insights into peak season 2022, and what to expect in the coming months.

Surprise #1: Prices are falling during shipping peak season 2022

Global freight and supply chains have faced massive disruptions over the past two plus years:

- Shutdowns in China and sharply curtailed air travel led to supply shortages

- Surges in demand for goods as people began shopping for home items led to a surge in freight prices and congestion

- A shortage of empty containers followed as companies struggled to keep up with demand – which continued to raise rates and increase delays

- The Suez Canal blockage led to – you guessed it – more delays and price increases

- The COVID-19 outbreak at Yantian and subsequent port shutdown curtailed freight supply

- Peak season 2021 brought an unprecedented price surge

- The war in Ukraine drove up energy costs

- The Shanghai lockdown cut freight supply once again

Since the rise in consumer demand in summer 2020, the industry has not returned to pre-pandemic conditions and instead has faced continual crises that have led to – and exacerbated – sky-high prices, delays, and congestion.

Rates dropped somewhat in early 2022, but in May they began falling dramatically – presumably because of a combination of lowered demand due to inflation and the Shanghai lockdown limiting availability of goods. The prevailing assumption was that once Shanghai reopened, pent-up demand, especially heading into peak season months, would drive prices up again. The industry prepared for a repeat of peak season 2021.

But the spike has not (yet) come. Instead, prices have continued to fall, even through the height of peak season.

In late July, Asia-US West Coat rates were 55% lower than they were at the start of the year and 64% lower than they were at the same time in 2021. Asia-US East Coast rates also fell 38% between January and July, reaching costs 50% lower than the same time last year. Rates from Europe to the US fell about 25% between January and May.

The dramatic drop of May-June has slowed, moving into a leveling-off, but we have not seen the spike we normally see this time of year.

A number of factors have likely contributed to this trend.

Falling demand

In the very early weeks and months of the pandemic, consumers stopped spending – and inventory stocks rose.

Then consumers started spending. Inventories went down – and businesses had to get creative to build them back up and meet demand amid serious delays, employing solutions including sourcing and shipping on alternate routes, ordering early, or even, in the case of very large enterprises, chartering their own freight ships.

Now, we are seeing inventory overstocks.

The most famous cases include Target’s excess in inventory, but two-thirds of small-medium Freightos.com businesses surveyed in early June reported drops in demand, likely driven by inflation.

Less demand for goods means less demand for freight, leading to lowered prices.

Orders placed in advance

In addition to lowered demand, because of last year’s exorbitant peak season prices, many businesses shipped their goods early this year.

In fact, more than half of the businesses surveyed by Freightos reported doing just that.

Orders shipped before peak season means less volume during peak season.

These two factors – lowered demand and orders shipped early – are contributing to current relatively low prices.

Surprise #2: Demand is falling but congestion persists

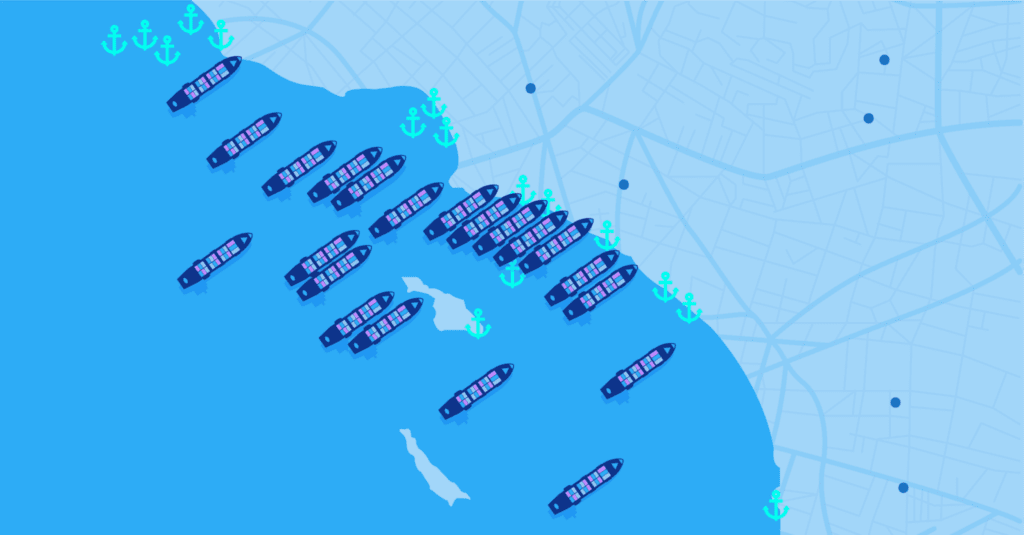

One of the supply chain challenges of the past few years has been delays caused by congestion. Major ports face backlogs of dozens of ships where in pre-pandemic times only one or two might have stood waiting, even during the height of peak season.

This has been particularly pronounced at the port of LA/Long Beach, and although the situation has improved, congestion persists. It has also spread to other ports around the country as importers try to move their goods to less crowded ports.

It seemed as though only a reduction in consumer demand for goods would really reduce the congestion.

And yet – that has not been the case.

Due to excess inventory, falling demand has meant more congestion than ever, at least in the short term: since new inventory has been arriving before old inventory has emptied out, warehouse space is tight. Containers continue clogging up ports as they wait for a place to go.

Thus, some decrease in demand is actually creating an increase in congestion.

Surprise #3: Contract rates are high even as spot rates fall

Freight contracts, though notoriously unenforceable, have long been popular with larger businesses to ensure space for their goods.

Contract rates have not been falling the way spot rates have over the past few months – in fact, they have been rising.

Many larger businesses have started splitting shipments and using spot rates for some goods while retaining contracts for much of their supply. But overall, businesses are keeping their contracts – and the high rates they come with.

Why are businesses not abandoning contracts for cheaper spot rates?

The answer is likely that with capacity still so tight and uncertain, contracts are still a more reliable way to ensure that goods will arrive on time.

However, methods like index linking and freight futures have allowed more contract reliability.

So what’s next?

There’s no clear answer about where global freight prices are headed in the coming months. But, here are some ideas to consider.

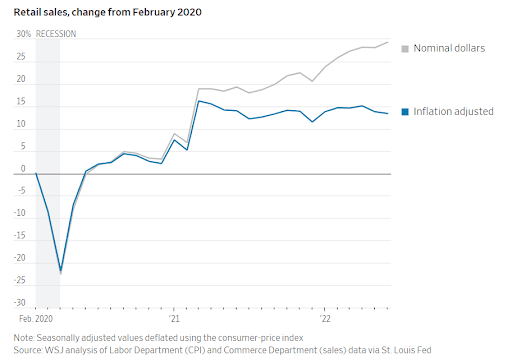

First, despite the rise in inventory, it’s not clear that demand is truly as low as it seems. Retail and import data from this year shows that in fact, imports and sales are not significantly down:

Wall Stree Journal data shows that retail continues to increase

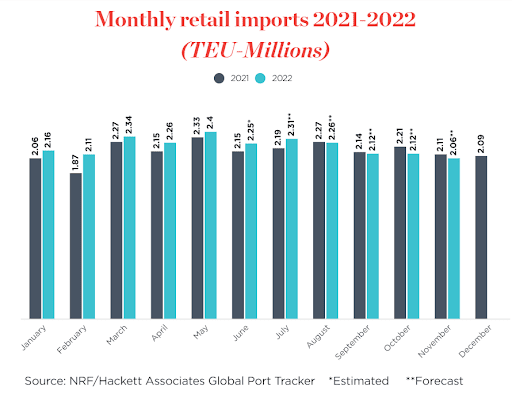

Similarly, imports have not seen dramatic changes this year compared to last, and are not expected to

According to the data, retail spending continues to increase or at least remain flat if you adjust for inflation. Import volumes are similar to what they were last year, and although they are expected to decline in the coming months, they are still much higher than they were in 2019.

So although we’ve seen a decrease in volumes and prices, both are still high compared to pre-pandemic levels.

In addition, as noted above, one of the factors driving down volumes is likely that many businesses shipped before peak season. That means that rather than signaling a real drop, low prices now could be the result of spreading out volume over a longer period of time.

With demand still strong and congestion persisting, we will likely not see anything too dramatic in the coming months. Rates may go down, but since they are starting from an extremely elevated place, they will likely remain high.

Still, there are some wild cards to look out for:

China’s Covid Zero policy

China’s Covid Zero policy has meant that shutdowns in response to even small numbers of cases could happen at any time. That means major supply chain disruptions are an ever-present possibility.

Labor issues

Labor shortages and strikes, particularly with port, trucking, and rail workers, have caused further disruption and could do so again. These issues also increase rates and congestion.

When it comes to freight, we now know to expect the unexpected. But in the meantime, the dramatic shifts of 2021 seem to have slowed.

Want more detail? Watch the webinar on this topic for a deep dive into peak season 2022: