What’s changed in a year?

You might not think about shipping containers and ocean freight when you click “buy” on your Amazon order, but there’s a direct connection between the two. When ocean container rates spike, so do the prices we pay.

So in January, as players across the global freight industry were discussing how to navigate higher freight rates, delays, and capacity shortages, Freightos.com, a global freight booking platform and part of the Freightos Group, reached out to our customers to find out how logistics disruptions are impacting them.

Since then, we’ve sent out two similar surveys – one in June and one at the end of November – to track the effect of increased supply chain disruptions on companies ranging from small businesses to enterprise importers.

A brief background on the “disruptions.”

If you haven’t been following the current supply chain crisis I recommend listening to our podcast miniseries, Ship Happens for an in-depth narrative, but for now, here’s a condensed overview:

- In March 2020 passenger travel came to a halt due to COVID and air cargo, which is carried in the belly of passenger flights, faced significant delays and disruptions. You might remember the toilet paper and PPE shortage during this time period.

- With almost everyone stuck at home, people began spending more money on “stuff” rather than travel or experiences, and demand for e-commerce soared.

- Meanwhile, ocean carriers were preparing for an economic slump similar to 2008 which negatively impacted the ocean shipping industry, so they were initially limiting activity to save costs.

- However, since buying goods manufactured primarily in Asia increased so significantly, demand quickly outpaced supply. Starting in July 2020, the impact of this trend became obvious when ocean freight prices shot up, and have continued rising.

- For example, if we look at recent peak seasons, the cost of shipping a 40’ container from Asia to the US West Coast in September 2019 was $1,437 according to the Freightos Baltic Index (FBX). In September of last year that increased to $3,744 and this past September freight rates shattered records at a hefty $20,586.

- On top of that, there have been shipping container shortages leading to significant delays, with door-to-door transit times going from an average of 43 days at the end of 2019 to 53 days at the end of 2020, and currently standing at 78 days.

Understandably, this hasn’t been easy on importers, especially when they’re trying to plan ahead and calculate margins and shipping times.

“We’re starting to book freight and we’re realizing that the budget we had put in for freight is almost 4 or 5X what we had thought it would be.” – Conor Lewis, Founder of FORT, excerpt from the first episode of Ship Happens: The Miniseries.

Now, let’s get back to how they’ve been handling it.

Let’s talk numbers.

In most survey questions there wasn’t a significant difference between the answers given by importers and exporters in January and in June.

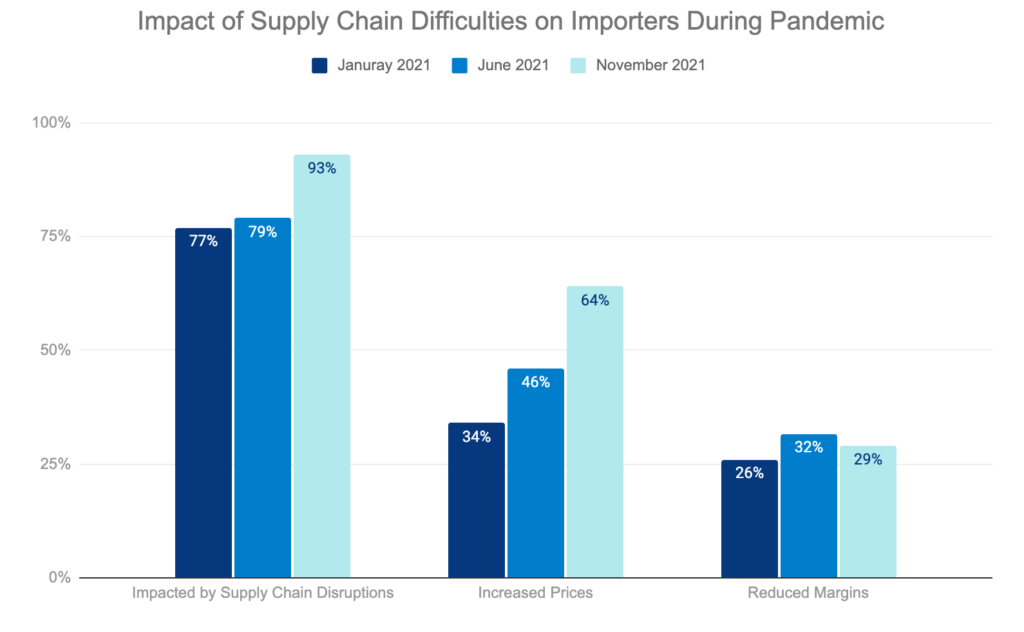

In January 77% respondents answered that they’ve encountered supply chain challenges since the pandemic began and in June 79% answered the same way. However, in our most recent survey, nearly all respondents (93%) reported experiencing supply chain difficulties.

In January and June, around 45% of importers reported raising prices on their goods in response to higher freight costs, while in November 64% of importers increased prices.

This is, of course, likely dependent on a variety of factors including prices for raw material, delays in transit times, and low-margin products being hyper-sensitive to shipping cost changes, unlike more expensive items like iPhones.

And prices for consumers are higher everywhere…

Since the end of this past summer, buzz around supply chain disruptions and a potential link to inflation entered mainstream conversation.

Already sky-high ocean prices from Asia to the US spiked 70% in late July in line with peak season demand and stayed at about that level through mid-November, reaching a high of over $20,000 per 40’ container in mid-September.

“In a normal year we might pay $3,000 or $4,000 per container. This year I think we paid closer to $20 grand for that container.” – Curt Nichols, Founder of Glade Optics, excerpt from the first episode of Ship Happens: The Miniseries.

So how does this impact what you pay for imported goods (aka most of what you buy)?

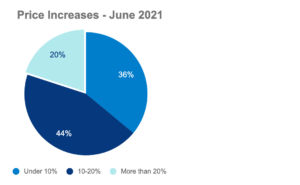

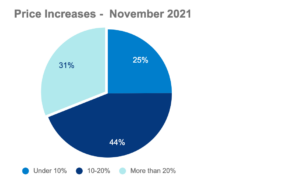

In November’s survey, nearly a third of businesses who responded that they recently raised prices did so by more than 20%, compared to only a fifth of businesses who reported similar price increases in June.

We found that pre-pandemic, ocean shipping costs per unit for smaller items ranged from $0.30 to $0.40, or about half a percent of the sticker price.

But elevated freight rates have pushed costs to $4-5 per unit. Even with increased sticker prices, ocean shipping contributions have climbed to 5% of the current inflated price tags.

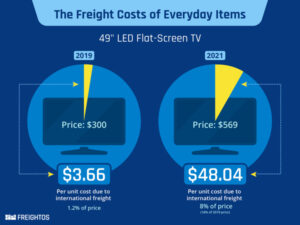

For bulkier items like large TVs, per-unit freight costs climbed from $3.66 to more than $48 and from 1.2% to more than 8% of the consumer price. This explains why more businesses are raising prices even higher than earlier in the year.

What about small businesses?

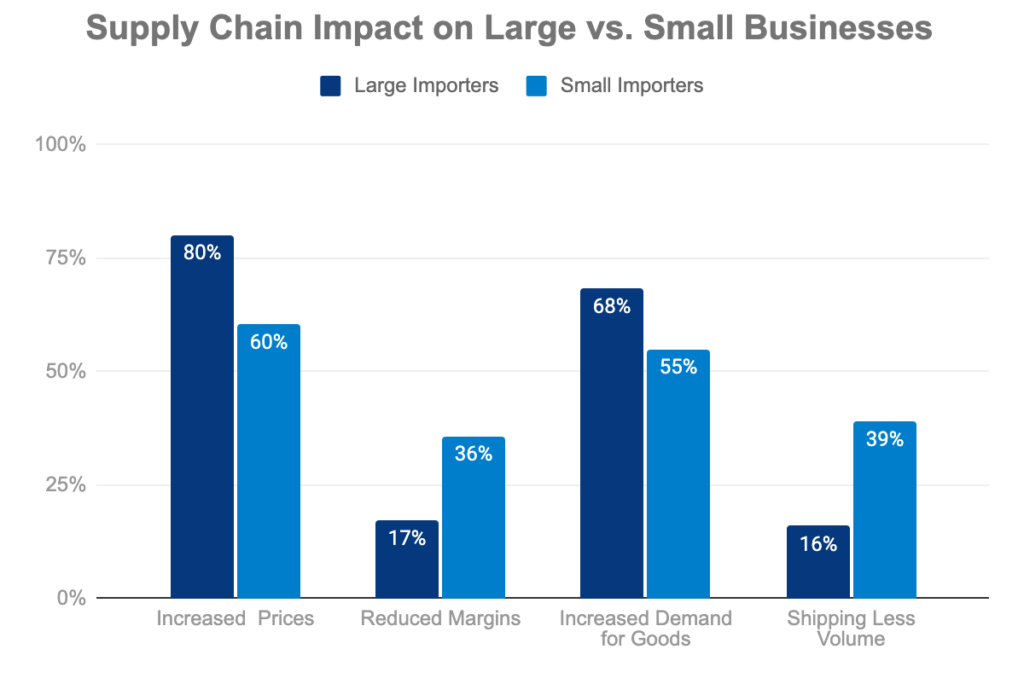

It probably doesn’t come as a surprise that small businesses are getting hit harder by these conditions. They’re showing less resiliency than larger companies who might have more diversified offerings, better margins to absorb cost shocks, or direct contracts with ocean carriers, all of which greatly reduce the exposure to freight rate spikes.

Compared to large businesses, small importers were twice as likely (36% vs. 17%) to have reduced their margins to accommodate rising costs. They are also less likely to have benefited from an increase in demand for their products (55% vs. 68%) and are twice as likely to be shipping less volume than before the pandemic (39% vs. 16%), mostly due to rising shipping costs (80%).

What’s the solution? Time to get technical.

About 30% of the importers have tried each of the following methods to mitigate the impact of supply chain disruptions:

- Using multiple logistics service providers.

- Booking containers directly with ocean carriers or investing more in relationships with their preferred forwarder.

- Opting to have their suppliers handle freight more often.

- Switching from ocean to air cargo or from full containers to LCL (Less than Container Load)

Looking to compare and book freight?

For most (70%), difficulties did not cause a change in sourcing, though about 15% of respondents switched sourcing to an alternate foreign country and 15% moved to domestic suppliers.

So, what does this all mean?

Two things are clear from these results. First, businesses are hustling to do the best they can to navigate a less than ideal situation. And second – there isn’t one best or quickest fix.

This is a good perspective to take when approaching the supply chain crisis as a whole: every sector within the logistics space is working as hard as they can to find the best way out of this difficult situation.

At Freightos that’s through digitization and standardization within the industry. But every company has their unique and valid approach, and at the end of the day every crisis contains opportunity for innovation – something which is especially welcome in a trillion dollar, legacy industry like global freight.

Sample size: 315 respondents, 58% very small businesses (up to $2m in annual revenue; 48% less than $1m), and 42% larger businesses, including some very large importer/exporters (>$2m in annual revenue, 28% >$10m)