The Opportunity for Amazon Sellers in Europe

- Amazon has five marketplaces and over 28 potential countries to sell to in Europe.

- Europe is the second largest B2C e-commerce market, worth $770 billion and currently has over 340 million online buyers.

- Over 80% of consumers in the UK, Denmark, and Germany already shop online.

The EU

28 countries in Europe are joined in a political and economic union (single market) called the European Union (EU). These countries still have local governments and laws, but many of the laws that apply in their country have been enacted by the European Parliament and apply across the union. Beyond legislation, there are a few aspects, though, that aren’t universal. For instance, so far only 19 countries have adopted the euro, the EU’s common currency.

Not all countries in Europe are members of the EU. Switzerland, Norway, and Russia are the most notable exceptions. It can get confusing, though, because sometimes “EU” and “Europe” are used interchangeably.

Getting Freight Into The EU

US imports usually arrive in Le Havre (France), Felixstowe (UK), Antwerp (Belgium), or Rotterdam, (The Netherlands), while most imports from China go through the Suez Canal, and usually dock at Hamburg (Germany). Shipments then usually travel inland by barge or rail to major distribution centers. Only urgent shipments are usually delivered by truck.

Air cargo enters via the major passenger ports, like Frankfurt (Germany), London Heathrow (UK), Paris (France), Milan and Rome (Italy), and Madrid and Barcelona (Spain).

Air freight arrives about 10 to 15 days sooner than sea freight, but shipments over about 100 kg will cost a lot more. Shipping by rail from China is becoming more popular, as it’s a middle ground between sea and air freight in terms of transit time and pricing.

VAT

Value-Added tax, or VAT, is an indirect tax (like sales tax). The big difference is that VAT is collected at each stage of production and distribution, including customs clearance at import. You can avoid paying VAT by enrolling in a duty deferment program, but beginner importers usually find the program too complicated to bother with. You may also be able to reclaim VAT, depending on the nature and level of business you think your sales operations in the EU will expand to.

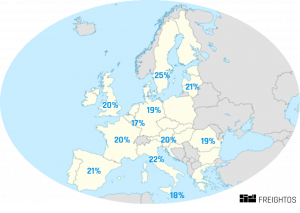

VAT in the EU is different from sales tax in the US in another way, too. Their rates are surprisingly high. They vary from 17% to 25% of the good’s value, depending on the country.

On the positive side, VAT processes are streamlined and transparent. All countries have pretty clear and accessible processes for getting a local tax ID. Setting up for VAT in one EU country has you covered for importing into any other country within the union Furthermore, once your goods are inside the EU, you can freely transport them from one country to another.

Customs Duties

Depending on your product and where it was produced, you may also have to pay customs duties (plus the VAT on customs duties). However, unlike VAT, customs duties on a tariff code are the same across all EU countries. Duty structures are usually around 5% to 10% of the shipment value, which includes freight costs among other items, but, like importing into the US, many goods are duty-free. And, again like the US, import tariffs can exceed 100% if anti-dumping rules apply.

Other EU Import Preparation

- EORI. You need an Economic Operators Registration and Identification number (EORI). This works like the IOR number does for US Customs. That is, it is how customs authorities identify each shipment’s importer (or exporter). The same number works across all countries in the EU. Apply for an EORI with one of the local customs authorities before you start importing.

- COO. Depending on the country of origin, you may need a Certificate of Origin.

- CE Marking. Some products, like electrical appliances, toys, machinery, and medical devices require CE Marking, which is proof that they meet European Health and Safety Standards. Check whether your product is affected, and confirm with your manufacturer whether your product is CE accredited. Much of the information covered in the Safety Standards & Labeling guide applies as much to importing to the EU as it does to importing into the US.

US Export Preparation

If you are exporting from the US into Europe, you will need to:

- Arrange Electronic Export Information (EEI) filing for the Census Bureau,

- Secure an Export license,

- Become a Foreign Principal Party in Interest,

- Be classified as a “known shipper”.

Your freight forwarder will help with all of these. If you work with a freight forwarder that deals extensively in Europe, they will help with what you on what you need to export from the US, and import into the EU.