Weekly highlights

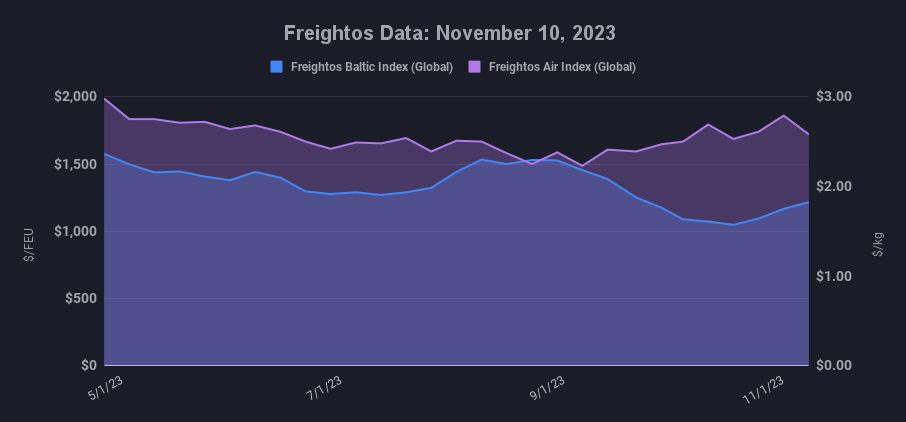

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) increased 6% to $1,711/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $2,421/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 11% to $1,381/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) climbed 1% to $1,551/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 3% to $5.56/kg

- China – N. Europe weekly prices fell 20% to $3.38/kg.

- N. Europe – N. America weekly prices climbed 1% to $1.84/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

The latest National Retail Federation US ocean import report shows that peak season extended into September as month on month import volumes climbed 4%. The NRF estimates that October imports decreased – though other measures report climbs through October too – and volumes are projected to decline through the end of the year.

With peak season now behind us, transpacific rates nonetheless continued to climb moderately from their October lows last week as carriers seek to keep vessels full by reducing capacity. The same was true for Asia – N. Europe prices last week, and more carriers have announced planned December GRIs for the ex-Asia lanes.

With higher costs and often sub-2019 rates, carriers like Hapag-Lloyd and others saw Q3 profits plunge compared to last year, though many managed to remain profitable. Hapag-Lloyd estimates global volumes will fall 3% this year with capacity growing 8%, and that overcapacity will persist next year as volumes growth of 4% will be outpaced by 6-9% capacity growth. Yang Ming thinks supply and demand could balance out by next year, but sees a worst case of four years until the two are aligned.

New transit reductions in the Panama Canal are already causing increases in congestion, and impacting some perishables trade between South and North America, though large container carriers have so far not been impacted strongly.

Transatlantic rates increased 9% last week, but at $1,108/FEU remain 43% lower than in 2019. Volumes on this lane were down 27% in September compared to 2022, though seasonal demand is driving an uptick in October and November. Nonetheless, blank sailings have not been significant enough to push rates up.

Freightos Air Index data shows China – N. America prices declined 3% but remain elevated at $5.56/kg last week while China – N. Europe rates fell 20%, back to about their early-September level. Despite the recent transpacific uptick, oversupplied carriers like FedEx are looking for strategies including shifting pilots to the passenger market.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.