Weekly highlights

Ocean rates – Freightos Baltic Index

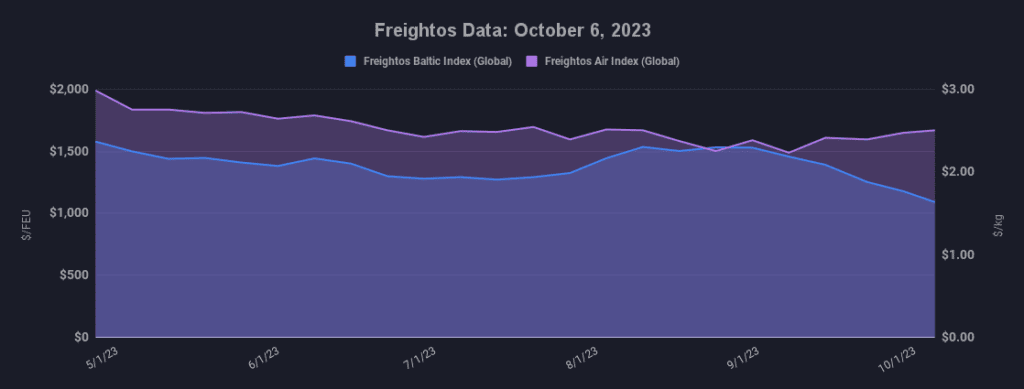

- Asia-US West Coast prices (FBX01 Weekly) decreased 11% to $1,499/FEU.

- Asia-US East Coast prices (FBX03 Weekly) fell 8% to $2,245/FEU.

- Asia-N. Europe prices (FBX11 Weekly) decreased 10% to $917/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 6% to $1,490/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 2% to $4.65/kg

- China – N. Europe weekly prices fell 5% to $3.76/kg.

- N. Europe – N. America weekly prices fell 2% to $1.64/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

The latest National Retail Federation US ocean import report estimates that August was indeed the peak for container volumes this year, with imports falling 1% in September. Volumes are projected to be level in October and then decline slightly through the end of the year as consumer spending remains resilient though its growth rate slows. Existing inventories by some importers and decisions to order early by others may have contributed to the brief and early peak in August.

Nonetheless, August volumes were on par with 2019, September and October ocean imports are projected to be 3-4% higher than pre-pandemic, and November/December at least 9% higher.

And though volumes have remained respectable by pre-COVID standards and are behaving in about normal seasonal patterns, ocean rates continue to fall with prices below 2019 levels on most lanes.

Transpacific rates to the West Coast fell 11% last week to about $1,500/FEU, and is the only major lane with rates still above 2019 levels. Asia – N. America East Coast prices decreased 8% to $2,245/FEU, 17% lower than in 2019, with Asia – N. Europe falling 10% to an extreme low of $917/FEU, 25% lower than pre-pandemic. Transatlantic rates are also approaching the $1,000/FEU mark this week.

For the transpacific, rates falling sharply on gradually declining volumes and alongside continued, significant capacity management measures by carriers point to overcapacity as the main driver of the current rate slumps, with excess capacity a major contributor to falling rates on the other lanes as well. And though carriers have already announced rate increases for November for Asia – Europe services, prices will only climb if liners are able to reduce capacity to current demand levels – a task all the more challenging as new capacity continues to enter the market.

Meanwhile, the European Union antitrust commission has announced that they will allow carrier exemptions to expire in April, a move some expect to have little impact on carrier controls on rates, but that could represent another challenge for liners.

Despite recent reports of some air cargo volume increases stoking some hope for air peak season, Freightos Air Index ex-Asia rates fell 2% to N. America last week and more than 4% to N. Europe.

The outbreak of war in Israel has so far had little impact on ocean operations there or in the region, though many passenger and freighter flights to Israel have been canceled.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.