At FreighTech 2023, the annual conference we hold each year to spark innovation and efficiency in the freight industry, I focused my opening remarks on digitalization, specifically on the rate of digitalization among air freight and ocean freight. It is indeed “A Tale of Two Modes,” each with its own story, pace, successes, and snags. In this blog post, I describe the different paths these modes took and where things stand at the close of 2023.

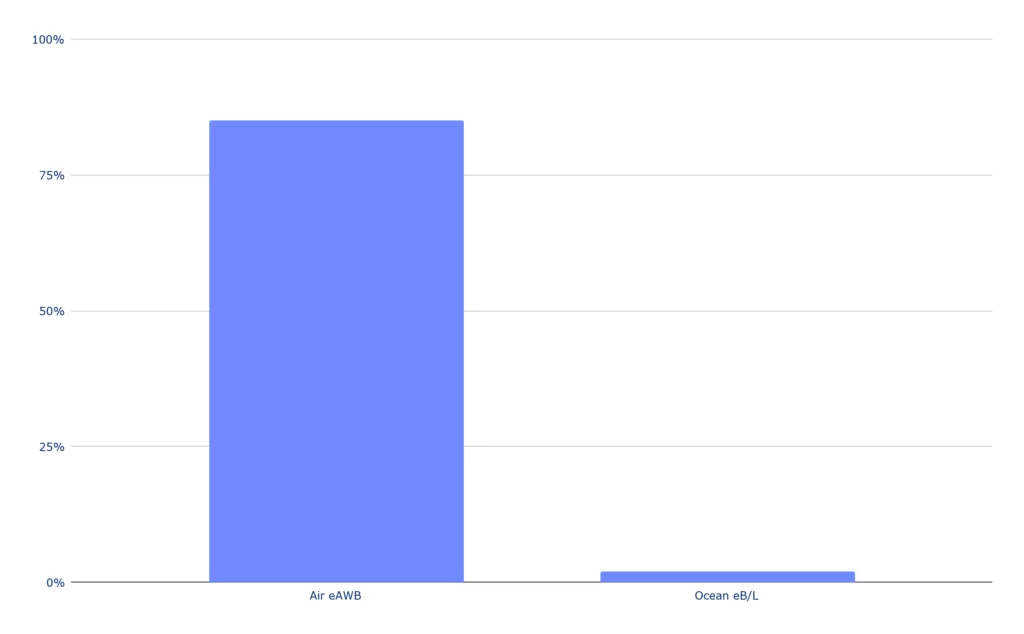

Here at Freightos, our vision is to digitalize international freight–air and ocean. But so far air freight and ocean freight have gone in different directions. Consider the most basic, almost trivial, level of digitization: replacement of paper waybills with digitalway bills. Air waybills are over 80% digitized (according to IATA), but ocean bills of lading are struggling to get to 2%.

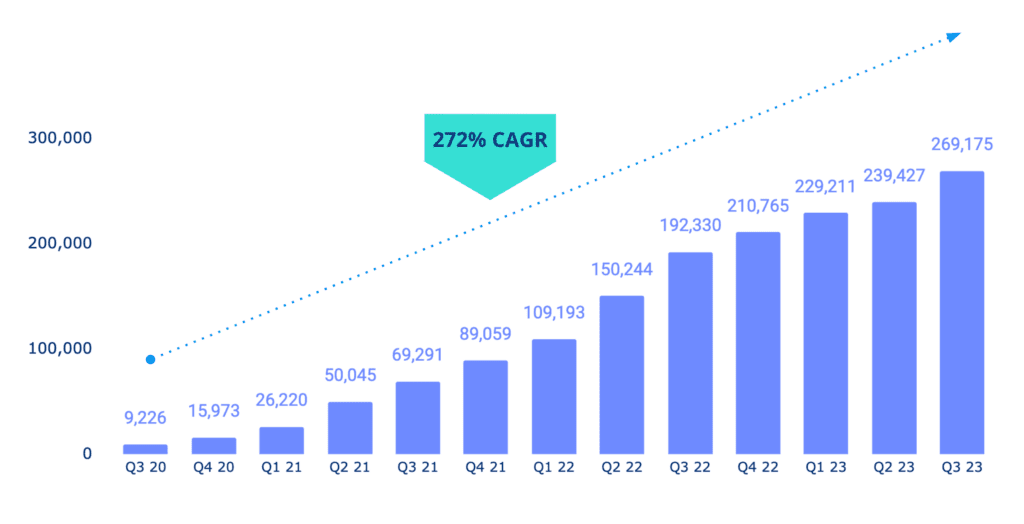

Replacing a piece of paper with a digital equivalent is really digitization rather than digitalization. Looking beyond digital waybills to digitalizing business processes, we always like to focus on bookings as the bellwether of digitalization. Instant eBookings on the Freightos platform have enjoyed a staggering compound annual growth rate (CAGR) of 272% in the last 3 years, with growth dominated by airline bookings. Remember that there was zero airline ebooking at the beginning of 2018. Now, just five years later, we exceeded a rate of 1 million eBookings per year in Q3 2023, mostly airline eBookings. That is a huge success story for the air cargo industry and as promised it has brought significant efficiencies.

There is progress in digitalizing ocean freight, but its been slow and inconsistent. For example, some carriers shared with us their APIs for contract rates, others for spot rates, some for rates but not ebooking, others share APIs via third parties who charge an exorbitant price for accessing the API. All of this deters adoption of the APIs which is ironic as they were designed to save time and money for the carrier. Not one ocean carrier has a full set of APIs available. Compared to forty airlines.

What has led to these differential outcomes? There may be several factors.

- Time and money. Transport across the ocean takes a long time, and people take out loans against the bills of lading. So more parties are required to adopt digital standards including banks.

- Speed and Urgency: Air cargo is used for faster shipping options, and the need for rapid communication and tracking is more critical in this industry. Delays of a couple of days have a more significant impact on air cargo shipments, which has therefore driven the adoption of digital technologies harder than ocean where delays are bad but not critical.

- Industry Structure: The air cargo industry is more fragmented compared to the ocean cargo industry. The top air cargo airline has a 6% market share, the top container ocean liner over 20%. The stronger competitive dynamic in air may drive quicker adoption.

That said, like a slow steaming ship, the ocean cargo industry is making progress, and as the benefits of digitalization become more apparent, and as standards and industry collaboration improve, the ocean cargo sector will gain momentum and eventually catch up. The handful of carrier APIs that have been shared with us provide hope and serve as a reminder that digitalization is not a sprint, it’s a marathon. Increasingly I think it’s an ultramarathon. And here at Freightos, we’re working closely with all industry stakeholders to run it together.