What’s working for ocean freight (and what isn’t)

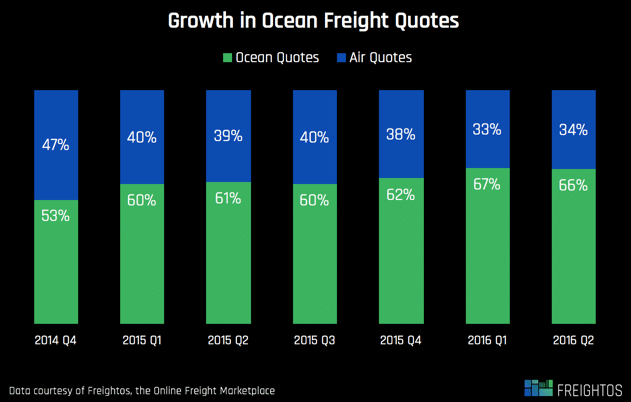

Ocean freight has had a complicated year so far. Beyond speed, one of air freight’s primary advantages over the ocean has always been reliable.But improved data forecasting and more predictable supply chains have become a boon for ocean freight, leading to an increase in ocean shipments at the expense of their more expensive aerial counterparts. Even items that were traditionally reserved for air – like cellphones and other high-value items – are now occasionally shipped by the ocean.

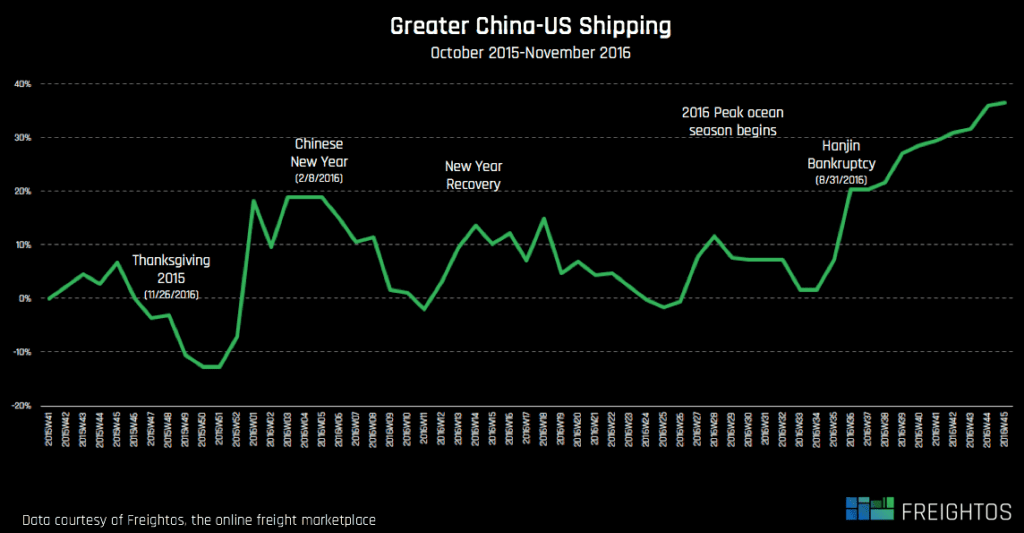

Data based on quotes generated using Freightos AcceleRat . Ocean carriers need all the volume they can get.Q3 of 2016 reinforced what we already know – it’s a tough time to be an ocean carrier. Overcapacity (to the tune of 10% of the industry’s container capacity as surplus space) and fierce competition pushed South Korean ocean carrier Hanjin into bankruptcy on August 31st, 2016, triggering a price uptick that held steady throughout the September holiday shipping surge.

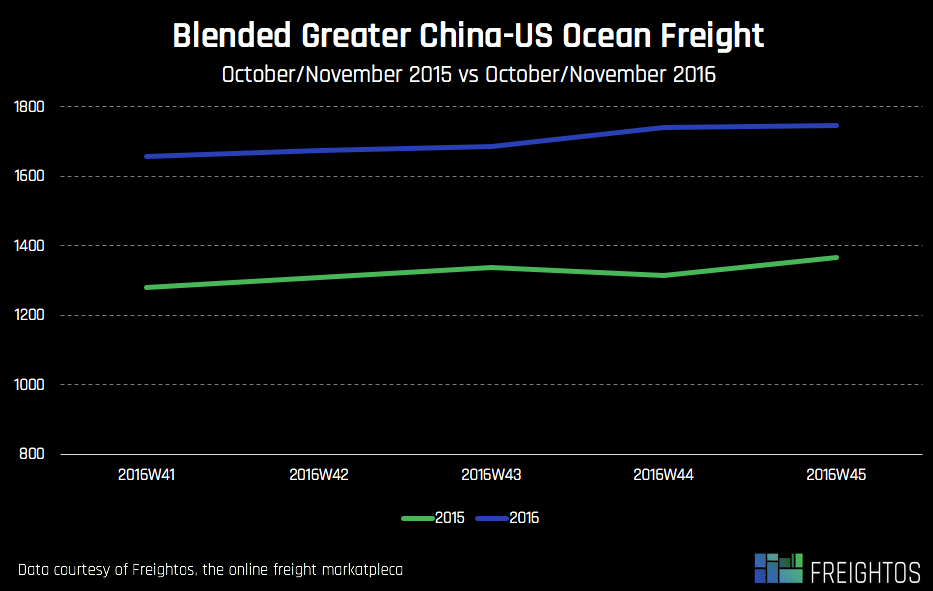

As a result, ocean freight spot rates for the past few weeks have hovered close to 30% higher than at the same period last year:

Black Friday proves how cheap ocean freight still is

But despite higher prices, there’s an important underlying message behind the daily dips and spikes.

Ocean freight is cheap.

How cheap?

We took a look at the front page of Best Buy’s Black Friday sales this year and estimated the ocean and air freight price paid to import the goods with Freightos Marketplace data.

The highest price for shipping any one unit (on a 50″ TV manufactured in Taiwan) was estimated at $20. At rock-bottom product prices of $200, shipping represented 10% of the TV’s price tag because, as mentioned above, ocean freight is ridiculously cheap.

Flying such a cheap heavy TV would have been prohibitively expensive. But for smaller, higher priced consumer electronics like cell phones, even air shipping prices can be fairly negligible (air freight for the 9.7″ iPad Pro is estimated at just 1% of the product value).

Let’s put that into perspective.

Shipping a 20′ container from Shenzhen, China, to Long Beach, California, costs about $1,700. Shipping it back is even cheaper. Storing that container’s contents for a year in Bronx, NY, would cost $3,576 dollars!

Sure, storage in New York City is expensive.

But even storage in wide-open Austin, Texas comes close – you’d still pay $1,260 per year to store that container’s contents.

Ocean freight is the grease in the wheels of international freight, moving 90% of everything we eat, wear and use. There may be a fair amount of criticism that can be levied at the occasionally struggling maritime industry, whether due to slow cultural changes or slow technology adoption.

But ocean freight works. The logistics technology wave now hitting the industry should make it even better, while hopefully reducing price volatility and enabling more efficient operations for ocean liners, forwarders and shippers.

Until then, here’s what you can expect from ocean freight prices…

Going forward (speculation ahead)

Traditionally, ocean freight prices start to dip off in the week of Thanksgiving. Which is why, beginning this week, we should start to see a slight decline in ocean freight pricing. That said, the Chinese New Year is early this year (January 28th, compared to February 8th last year) so the real present under the holiday tree for ocean carriers may be an earlier post-holiday spike as US importers rush to beat the Chinese New Year shut down.

Last year, ocean prices started to climb exactly one month before the Chinese New Year. Which means that as soon as people come back from holiday break (or if they’re prepared, right before they go), expect prices to start to climb.

Until then, enjoy your Thanksgiving Turkey. It may be one of the only thing you’ll consume this holiday season that’s made in the USA.