Red Sea Shipping Disruption News & Updates

Despite the Operational Prosperity Guardian naval task force, Houthi attacks persist. Recent escalations involve an attack on a Maersk vessel, triggering heightened US response and UK considerations of targeting Houthi positions in Yemen. Iranian warship entry into the Red Sea and ongoing Houthi missile attacks further escalate regional tensions.

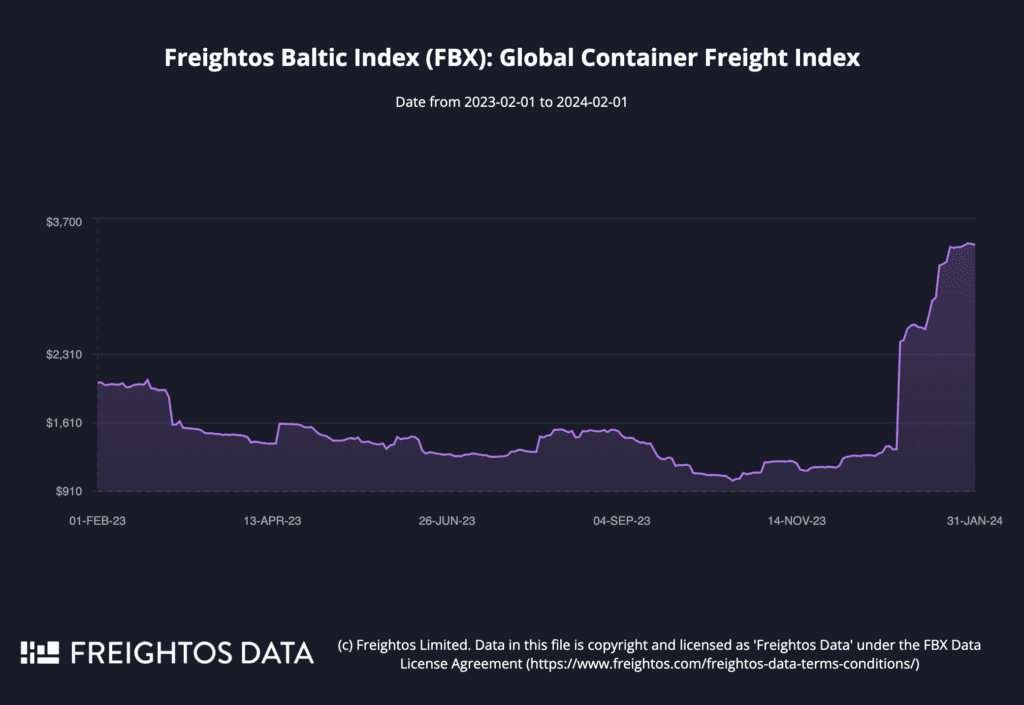

Global freight encounters disruptions as container carriers reroute away from the Suez Canal, resulting in extended lead times and potential port congestion. Freight rates surge, with Asia-N. Europe rates are up 173%, Asia-Mediterranean prices doubling, and carriers implementing surcharges ranging from $500 to $2,700 per container.

Stay Ahead of Red Sea Shipping Disruptions

Get real-time updates and expert insights with Freightos Terminal

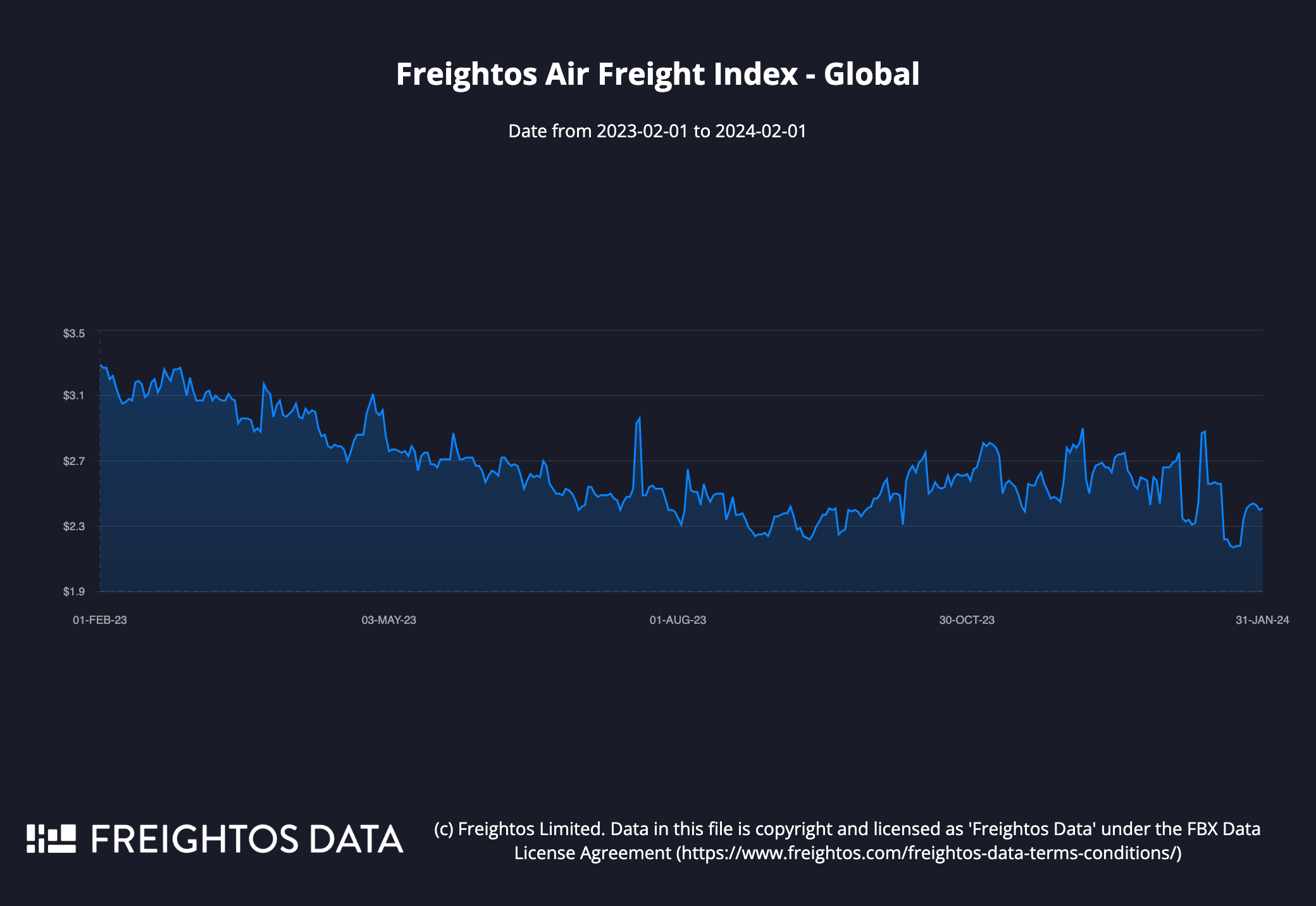

Operational challenges include adjusting schedules, adding vessels, and addressing potential congestion and shortages. Carriers, better equipped than during the pandemic, strive to manage diversions and maintain container traffic flow. Despite these challenges, air cargo currently shows no significant impact from ocean freight delays.

In air cargo, some analysts are expecting the delays in ocean freight to lead to some shift of more urgent volumes to sea-air services or air cargo alternatives. So far there have not been reports of any significant air cargo bump, though. Freightos Air Index rates for Asia – N. America were level last week, while Asia – N. Europe prices decreased.

For more about the Houthi Attacks in the Red Sea and Suez Canal disruptions, click here.

Market Updates, Shipping Costs, and Delays

Amid ongoing military strikes by the US and the UK on Houthi positions in the Red Sea region, the global supply chain faces a series of challenges. Despite diplomatic efforts, attacks in the Red Sea have continued throughout the week, raising concerns about the stability of this crucial maritime route.

European importers have been grappling with reports of inventory shortages due to delays, while Asian export hubs are experiencing tight space and equipment availability. However, it is worth noting that congestion levels have remained relatively minimal, and there are early indications that space and equipment availability may be improving.

As the Lunar New Year approaches, the pressure on the ocean shipping industry is intensifying. Last week, ocean rates from Asia to North America surged, with rates to the West Coast increasing by 38% to surpass the $4,000 per forty-foot equivalent unit (FEU) mark. Rates to the East Coast also climbed by 21%, reaching around $6,000 per FEU. Meanwhile, rates from Asia to North Europe and the Mediterranean have stabilized at approximately $5,500 per FEU and $6,500 per FEU, respectively.

In response to these challenges, carriers are taking steps to adjust and accommodate the new longer routes, to improve reliability in the coming weeks. Despite general rate increases (GRIs) and surcharges announced for February, it appears that freight rates may be nearing their ceiling, particularly considering the urgency of shipments before the Lunar New Year.

While there were expectations of a significant shift to air cargo due to delays in ocean shipping, the effects have been moderate thus far. China-North America air cargo rates increased by 11% last week, reaching $5.33 per kilogram. However, these rates remain below the levels observed at the end of December. In contrast, China-North Europe air cargo prices have declined. Notably, Middle East-to-North Europe prices have surged by 24% in the last two weeks, potentially indicating a partial shift from ocean to sea-air transportation in this region.

In conclusion, the global supply chain continues to face challenges due to ongoing conflicts in the Red Sea, delays in shipping, and the approaching Lunar New Year. While ocean freight rates have surged, carriers are working to enhance reliability, and air cargo remains a viable option for some routes. The coming weeks will be critical in determining how the supply chain adapts to these ongoing challenges and whether freight rates will stabilize or continue to rise.

Want updates sent right to your inbox? Sign up for our weekly newsletter here.

Real-Time Shipping Insights at Your Fingertips

Freightos Terminal delivers the most up-to-date shipping news and freight events as they happen. Sign up for free today and stay ahead of the game.

Ocean Freight Market Update & Forecast for 2024

Ocean rates spiked across ex-Asia lanes as Houthi attacks continue and Red Sea diversions push up costs and tie up capacity. Carriers are responding with increased rates and surcharges, aiming to surpass the $6,000 per forty-foot equivalent unit (FEU) mark. Backhaul rates have doubled since mid-December, signaling a complex market environment.

Rates for Asia to North America’s West Coast shipments are sharply rising, with carriers expected to reach the $5,000 per FEU mark mid-month. Similar trends are seen in transatlantic routes, with carriers announcing substantial General Rate Increases (GRIs) up to $5,000 per FEU in February. The industry anticipates capacity shortages and congestion in the coming weeks, easing only as demand softens towards late January.

In transpacific air cargo, rates remain stable, but China to Northern Europe rates have risen to $3.67 per kilogram this week, up from $3 in December. This increase may reflect a shift from ocean to air cargo due to extended ocean transit times.

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) increased 38% to $4,099/FEU.

- Asia-US East Coast prices(FBX03 Weekly) climbed 21% to $6,152/FEU.

- Asia-N. Europe prices(FBX11 Weekly) fell 1% to $5,456/FEU.

- Asia-Mediterranean prices(FBX13 Weekly) fell 5% to $6,449/FEU.

The Pentagon believes that US and UK strikes in Yemen are degrading Houthi’s abilities to carry out attacks on Red Sea traffic, but despite these steps and new attempts at diplomatic pressure, the attacks continue and so do the widespread container traffic diversions away from the Suez Canal.

Ocean carriers are omitting some port calls in the Red Sea and Middle East, as well as at some Mediterranean ports as they adapt. In the meantime, there are reports of inventory shortages for some European importers as shipments are delayed or taking longer to arrive. And though there are still reports of tight space and equipment at Asian export hubs, congestion remains minimal, and there are signs that space and equipment availability may already be improving.

With these operational challenges and the Lunar New Year rapidly approaching ocean rates from Asia to N. America increased 38% to the West Coast last week, past $4K/FEU and 21% to the East Coast to the $6k/FEU level, while Asia to N. Europe and Mediterranean rates leveled off at $5,500/FEU and $6,500/FEU respectively.

Carriers are still working to add vessels and adjust ongoing schedules which should accommodate the longer voyages and help improve reliability in the coming weeks, and demand-side pressure is expected to ease in the period after LNY too. So as operations improve and with pre-LNY urgency likely a significant contributor to rate increases so far in January, freight rates – despite GRIs and surcharges announced for February – may be reaching their ceiling.

Ocean delays have pushed some shippers to alternatives like rail or land-bridge options. And though there were expectations of a significant move to air and sea-air logistics, so far the shift seems moderate and more pronounced for sea-air than for air cargo. Like in ocean freight, demand for alternatives should also ease after LNY.

Freightos Air Index data shows that China – N. America air cargo rates climbed 11% last week to $5.33/kg, but are below levels at the end of December, while China – N. Europe prices have declined for the past two weeks. Middle East – to N. Europe prices, meanwhile, climbed 24% in the last two weeks to $1.80/kg, possibly reflecting some ocean-to-sea-air shift.

These are container freight rates for the second week of January 2024 according to the Freightos Baltic Index:

| FBX Lane | Global | Asia – US West Coast | Asia – US East Coast | Asia – North Europe | North Europe – US East Coast | |

| This Week | $3,411 | $4,099 | $6,152 | $5,456 | $1,168 | |

| Last Week | 10% | 38% | 21% | -1% | 0% | |

| Last Year* | 57% | 210% | 134% | 60% | -75% | |

| * Compared to the corresponding week in 2023 | ||||||

Air Freight Market Update, Delays, Cost Increases, and Forecast for 2024

The seasonal lull combined with overall low demand is pushing volumes below pre-pandemic levels at some of Europe’s major hubs, though some in the industry are hopeful that electronics product launches set to begin soon could drive some peak season rebound in the coming months nonetheless.

Air rates – Freightos Air Index

- China – N. America weekly prices increased 11% to $5.33/kg

- China – N. Europe weekly prices fell 5% to $3.16/kg.

- N. Europe – N. America weekly prices increased 2% to $1.98/kg.

Amazon Shipping Costs in 2024

Keeping up with door-to-door pricing for Amazon FBA shipping can be a hassle. With data from thousands of weekly pricing points from freight forwarders, we’ve developed a weekly index of freight prices including for Less than Container Load (LCL), Full Container Load (FCL), and air cargo, from major export cities in southeast Asia to the most popular Amazon fulfillment centers in the US.

Want to know what the rates are instantly? Check out Freightos.com’s FBAX, the Amazon FBA freight index.

With data from thousands of weekly pricing points from freight forwarders, we’ve developed a weekly index of freight prices including for Less than Container Load (LCL), Full Container Load (FCL), and air cargo, from major export cities in southeast Asia to the most popular Amazon fulfillment centers in the US.

Read up on how Amazon sellers can deal with rapidly changing consumer demands as well as inventory challenges HERE.

Shipping Delays Impacting Your Business?

Freightos Terminal helps you compare quotes and modes, plus track shipments

Will Shipping Prices Keep Going Down?

In the current situation, many importers and exporters are wondering when they can expect freight rates and shipping prices to level off. The answer? Not yet.

But, despite potential delays and volatile freight shipping costs, there are a few steps importers can take right now:

How to navigate the current freight market:

- Compare at least a few quotes and modes to make sure you are getting the best cost and most efficient service possible.

- Buffer your freight budget and transit time for changes. Costs due to unforeseen delays or limited capacity can arise, so be prepared.

- Explore warehousing options to mitigate the effects of lowered demand and business restrictions in the US.

- Pay attention to the profitability of your goods and consider if a pivot could be worthwhile. Additionally, remember to factor in freight costs when assessing profitability.

How small or midsize importers can plan for operational success on Freightos.com:

- Understand that delays and extra charges may arise. Freight forwarders are trying their best to move goods on schedule without additional fees, but in this unstable period, delays and additional charges can occur out of forwarders’ control.

- Consider which shipping mode is best for you right now. During non-pandemic times, ocean freight is typically far cheaper but has a significant lead time. If your transit time demands it, ship by air and you’ll have confidence in the transit times.

- Book now if you can. Freightos.com is fully operational, so book orders now to get goods moving as quickly as possible.

- Communicate regularly with your freight forwarder. This is more important than ever – staying in touch means you’ll have a better handle on your transit time and stay on top of any changes that may arise.

- Make sure that you have the manpower to accept your goods upon arrival. This will minimize delays.

How to stay informed:

- Keep up to date on the industry with our weekly freight market update.

- Check out our daily FBX ocean rates index to help you stay on top of freight rates in 2024.

- Check out our predictions for freight market trends in 2024.

As always, we at Freightos.com are here to help. Please reach out if you have any questions or concerns.