You want to import a new product, but before placing an order with your supplier, you first want to know what the total cost of shipping will be.

But that is easier said than done.

Freight quotes generally include much (much) more than just the freight rate and can also fluctuate depending on the season, route, origin, destination, category of import, and whether the groundhog sees his shadow on February 2nd.

Aside from the charges included in a freight quote, you’ll also be charged surcharges, taxes, duties, fees, and possibly penalties — some of which are avoidable.

Over 40% of shipments are hit with additional charges and the average amount charged is $290. Many of these charges could be avoided.

Added charges can really add up, making the difference between profitability and loss. That is why it’s important to understand additional charges and what you need to do to avoid them. Keep on reading or click below for a quick tool that measures just how exposed to added fees you might be.

Looking for live quotes from vetted providers?

The Complexity of Freight Pricing

As the United Nations Conference on Trade and Development (UNCTD) explains, freight rates are very susceptible to changes in global market forces and that translates to rapid fluctuations in pricing:

“Cargo volumes and demand for maritime transport services are usually the first to be hit by political, environmental and economic turmoil. Factors such as a slowdown in international trade, sanctions, natural disasters and weather events, regulatory measures and changes in fuel prices have an impact on the world economy and global demand for seaborne transport. These changes may occur quickly and have an immediate impact on demand for maritime transport services.”

At Freightos.com, bringing transparency to freight pricing is a driving force for what we do.

A lot of the questions we see from importers using our platform are about added costs to freight quotes, so we compiled a comprehensive list of the most common expenses involved when shipping goods.

Many of these costs are included in the freight quote, so importers on our platform don’t need to navigate a sea of freight acronyms and won’t be surprised by unexpected fees and surcharges.

Freight Quotes & Rates

Freight rates are the cost of shipping items from one location to another. Factors that impact final freight rate include mode of transport, weight and size of items being shipped, fuel prices, capacity, season, shipping route, and more.

Ocean Freight

Ocean freight is the most common mode of transport that importers and exporters use, accounting for 90% of all products shipped. Freight quotes for ocean and sea include any expenses associated with moving freight from the port of origin to the port of destination.

The charges outlined in this guide apply to ocean freight unless otherwise indicated.

Air Freight

Air cargo is used by global importers and exporters when they need to get goods somewhere rapidly and reliably. While 90% of everything is shipped by ocean freight, air freight is faster. China-US freight shipping time, for example, is 20-30 days by ocean and just three days by air cargo — but the costs are much higher.

Here are some of the fees associated only with air freight that importers should be aware of:

A consolidation fee is generally applied to LCL and air cargo shipments and covers the cost of consolidating loads from different shippers into one single shipping container.

- Fuel surcharges (FSC)

This fee is assessed by a carrier to account for variations in fuel costs and protect from the volatility of fuel prices.

This surcharge only applies to air freight and covers additional security measures mandated by airport authorities.

- Airline handling surcharge

Airlines often use third party processing services to handle and dispatch cargo, including disassembling and repacking air freight pallets for distribution.

- Container freight station (CFS) handling charge

These charges apply to services provided when receiving exported cargo and packing them into containers. For example, moving empty containers, emptying and repacking (known as stuffing) cargo, and container storage.

Shipping Security & Insurance

When shipping items cross border, importers will cover the costs of security, safety, and insurance against damage.

International Ship and Port Facility Security Code (ISPS)

The ISPS fee covers a set of comprehensive global security measures implemented after 9/11.

Security Fee (SEC)

This is a standard security fee charged by ports per LCL or FCL.

Cargo Insurance

Cargo insurance covers the cost of lost, stolen, or damaged goods in case of an unforeseen event during transportation. Shippers should purchase cargo insurance according to the applicable incoterm.

Palletization

Palletization involves wrapping loose cargo onto pallets to make loading faster and easier. Cargo is also better protected from damage when palletized, but because of the pallets’ dimensions this can impact the quantity of goods shipped.

All LCL shipments are palletized, incurring a fee for equipment, materials, and labor.

Fumigation

Depending on the cargo, packaging, or type of pallets used, shipments may require fumigation and fumigation, generating additional costs.

Export License

This is a legal document granted in the country of export permitting specific commodities to be shipped. Suppliers are responsible for obtaining this license, but if it is required and not presented, the importer may be hit with a fee to cover getting the document and any delays caused.

Obtaining an export license when required accounts for 15% of all additional charges on freight shipments.

Adjustment Surcharges

Freight shipping can’t always be smooth sailing. For carriers, this means adjusting prices to cover unexpected costs, whether these are caused by the importer, the global economy, or dock workers’ unions.

The most common additional charges applied to freight shipments are weight and dimension adjustments, accounting for half of all applied additional charges.

This means that the best way to avoid unnecessary charges on your shipment is to submit correct weight and dimension information.

Try our chargeable weight calculator to reduce your chances of getting charged dimension and weight adjustments.

General Rate Increase (GRI)

A GRI is the amount by which ocean carriers increase their base rates across specific lines, generally as a result of increased demand driven by international trade and markets

Bunker Adjustment Factor (BAF)

BAF is based on TEU, to smooth out the effect of oil price fluctuations on carrier costs. It periodically changes, typically monthly or quarterly. The BAF rate is a non-negotiable pass-through charge.

Currency Adjustment Factor(CAF)

This fee accounts for currency fluctuations and stabilizes main leg costs in the short term.

Peak Season Surcharge (PSS)

Carriers implement PSS during the shipping peak season (between July and October) to cover the increase in operational costs. This can greatly increase overall international shipping costs.

Preparing for peak season could mean booking with added lead time or paying for premium. Learn more in our peak season import guide.

Emergency Bunker Surcharge (EBS)

The EBS is an add-on charge to the BAF covering fluctuations in fuel prices. The EBS may vary by carrier, shipping container type, and shipping route and will be included in freight quotes if applicable.

Emergency Imbalance Surcharge (EIS)

When there are multiple ports of destination, the amount of inbound cargo may exceed the amount of outbound cargo, leaving empty containers on the quayside. The EIS is charged to cover the costs of relocating these containers.

Heavy Lift Surcharge (HEA)

An additional charge for handling heavy cargo that weighs more than the standard limit for a shipment.

Overweight Surcharge (OWS)

A surcharge is applied for extra input or resources for oversize or overweight shipment.

Out of Gauge (OOG)

This fee is charged on loads with dimensions that don’t conform to the container.

Emergency Rate Restoration (ERR)

This surcharge covers sudden increases in shipping costs.

Congestion Surcharge

This surcharge protects against unexpected events that cause delays at the port. This often occurs as a result of worker unrest and strikes.

Container Seal Fee

Containers transported via ocean freight must be secured using specific seals. If the seal needs to be installed or changed by the carrier, this fee will be charged.

Low Sulfur Charge (LSC)

Ships taking part in initiatives to reduce carbon footprint use low sulfur fuel that is more expensive than standard bunker fuel. This charge covers the difference in cost.

Lane Charges

All lanes are not created equal. If you’re importing goods through specific zones that are particularly risky, you’ll have to pay an additional fee.

War Risk or Piracy Surcharge

Carriers that move goods through conflict zones or high risk lanes will charge extra to cover the cost of potential hazards. Beyond actual armed conflict, this surcharge also anticipates needing to reroute shipments or add security in zones with escalating conflicts, hijacking, and piracy.

Pirates and warlords can wreak havoc on a shipment, but so can low water levels, expensive river tolls, and travelling routes near densely populated regions. Each time a carrier needs to cover a cost, this trickles down to the importer’s freight costs.

Here are some lane specific charges:

- PCC (Panama Canal Charge)

- SUE (Suez Canal Surcharge)

- ADE (Aden Gulf Surcharge) / GAS (Gulf of Aden Surcharge)

- LWS (Low Water Surcharge)

- SMD (Security Manifest Documentation Fee)

- RPT (River Plate Toll)

Usage & Storage Fees

Carriers, ports, and warehouses generally include a set amount of time for equipment or container usage. Once the time is up, importers will be charged delay fees. Importers have a limited window to accomplish each step in the shipping process before costs start to accumulate, making it vital that logistics providers are organized and move swiftly. As the adage goes, time is money.

Demurrage

Demurrage fees are charged by shipping lines while a container is being stored, generally at the port. Importers will have a set amount of free time to keep containers in the port, after which demurrage is charged on a daily basis, increasing over time.

Detention

Detention charges are collected when cargo loading or unloading takes longer than the free time allocated, usually two hours. Detention is charged at an hourly rate.

Warehouse Fee

LCL shipments are first unloaded at a deconsolidation warehouse and then picked up by the consignee. If there is a delay in picking up shipments, importers will be charged a fee depending on shipment volume.

Per Diem

Per diem is a fee applied when equipment or containers are not returned after the allotted free time. This charge is in place to encourage importers to swiftly unpack and return shipping equipment.

Storage Fee

This fee is levied by deconsolidation warehouses, trucking facilities, and other storage entities for containers stored on the premises. Unlike the other charges on over usage of equipment or facilities, this fee applies to container storage.

Terminal Handling Charges (THC)

This is the main port charge applied to ocean freight shipping. THC covers most costs associated with using the port or terminal facilities, including access, equipment maintenance, equipment use, and labor (stevedoring). In addition, containers arriving at destination ports are unloaded, moved, and stacked. Terminal handling charges apply to all of these services.

Customs Duty & Tariffs

Customs duty is levied by governments when goods are transported across borders. This import/export tax regulates the movement of goods globally and ensures control of restricted items.

Taxes and duties can climb fairly high, sometimes costing more than the freight rate.

[tip title=”You should know”] Consider the total cost of taxes and duties when calculating freight shipping to decide whether a certain product is worth importing. [/tip]

When shipping to the US, all non exempt goods are subject to duty computed according to the Harmonized Tariff Schedule (HTS). HTS codes provide the applicable rates and categories for every class of goods.

Customs Brokerage

Customs brokers are licensed logistics experts tasked with ensuring that shipments meet import or export standards and regulations.

Retaining a customs broker can help importers manage all necessary documentation, duties, taxes, and payments.

Shipments that don’t meet customs requirements can be held or returned at the shipper’s expense, or even confiscated, making the cost of customs brokerage a worthwhile investment in many situations.

Customs Clearance

Customs clearance is how customs authorities verify that imported goods are ready to go to market. Customs inspection, transportation to the inspection warehouse, and the use of equipment during inspection are attached to fees.

In addition to customs clearance inspection fees, delay charges including demurrage and per diem may be applied if customs holds containers for inspection beyond the allocated free time.

Customs agencies can also impose fines on importers who don’t have their documents and requirements in order, for example if the container seal number doesn’t match the number on the Bill of Lading.

Customs Bond

A customs bond is purchased from a surety and operates as an insurance policy guaranteeing that duties and taxes will be paid on imported goods even if the importer fails to do so.

Importers can secure either a single bond on individual shipments or a continuous bond that covers all shipments for a calendar year.

A continuous bond can save you money and hassle if you plan to ship multiple times in one year.

Importer Security Filing (ISF)

This fee is typically included in customs clearance charges and covers advance cargo reporting requirements for ocean freight shipped to US ports. The ISF must be filed before the shipment’s departure and identifies low-risk shipments for early release from customs. Failure to submit the ISF will be met with heavy fines.

Entry Summary Declaration (ENS)

Similar to the ISF, any cargo bound for an EU port must be accompanied by this filing to facilitate security assessment of ocean freight. Other countries have similar filing requirements, for example the AFR in Japan.

Customs Release Fee

This fee is charged by customs brokers and covers processing, preparing, and submitting customs entry documentation to the CBP.

Taxes

Most merchandise imported into a country is taxed.

In the EU, tax rates are known as VAT and are calculated as a percentage of the total customs value of the imported goods under the CIF incoterm. The total customs value includes merchandise value plus insurance and shipping costs.

In the US, tax rates are calculated under the FOB incoterm as a percentage of the customs value of imported goods.

Federal Excise Tax

This tax applies only to specific goods such as alcohol or gasoline. Tax amounts and categories are determined by the IRS and collected from importers by CBP.

Trucking & Drayage

Inland trucking charges involve picking up and delivering shipping containers from one part of the country to another. These costs may vary depending on load time, location, required equipment, and other factors.

The fees for trucking are known as drayage and any additional charges are known as accessorial charges.

Accessorial charges cover special equipment such as liftgates and delivery to non-commercial destinations. These charges are most commonly applied to less than truckload (LTL) shipments.

Pre-Pull

This charge applies to early container pickup from the port, typically in cases where cargo must be loaded in a short time frame.

Redelivery

Containers must be stored in a secure facility if loading isn’t completed in one shot. The truck will re-deliver the container to complete loading the following day, however this incurs a fee.

Chassis Redelivery

This fee applies when the truck chassis needs to be picked up and moved to the location where the shipping container is being loaded or unloaded.

Pick Up & Delivery

If not already included in the shipment booking, these fees are charged separately from the freight quote.

Packing & Unpacking

If professional packing and unpacking services are used to prepare cargo for shipping, this charge will apply.

Container Loading

Trucking costs don’t include loading and unloading and will require an additional service. Typically shippers have a limited number of hours to complete loading and unloading, beyond which additional fees apply.

Documentation Fees

Freight shipping involves a lot of paperwork and charges, in fact some of the paperwork is also associated with added charges. Depending on the shipment type, destination, customs requirements, and other factors, importers will likely have to pay for issuance of documents.

Bill of Lading

The Bill of Lading is mandatory for all shipments and is associated with an issuance fee. All information included on the Bill of Lading needs to match the shipments packing list.

Once issued, any document errors that need to be corrected will incur an additional fee.

While the Bill of Lading is the most common shipping document, many additional documents carry a fee for submission. These include:

- Certificate of origin

- Validation of titles

- Packing list completion

- Export certificate issuance

- Transit document

- Product-related certificates

Ensuring that these documents are correctly filed and any fees are paid in a timely manner is vital to managing global freight shipping.

Automated Manifest System (AMS)

The AMS is an electronic information transmission system operated by US Customs and Border Protection (CBP). Air and ocean freight shipments into the US require an AMS filing with detailed information about the cargo and this carries a fee.

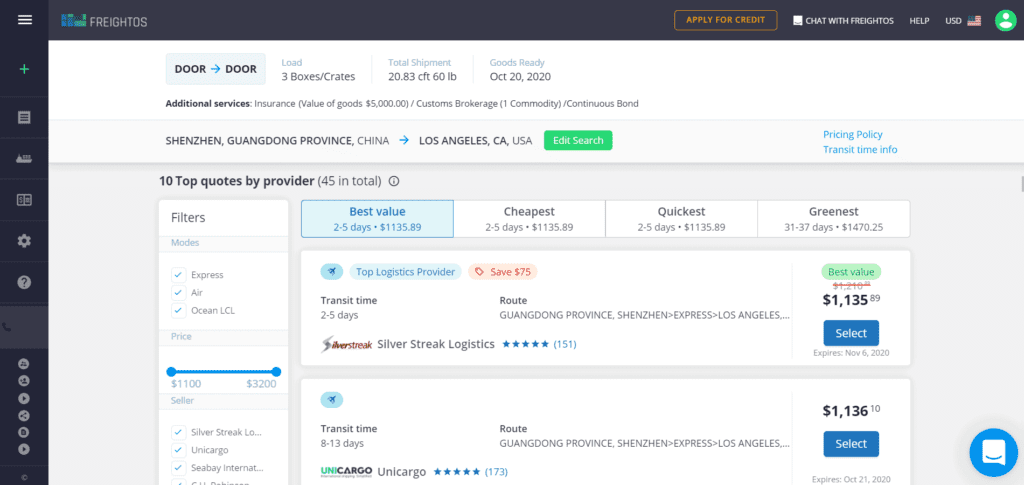

Freightos.com: Smooth Shipping, Transparent Pricing

Even seasoned importers can be overwhelmed by the complexity of freight pricing. For entrepreneurs just getting started, it can be full-on intimidating.

Between freight costs, customs duties and fees, seasonality, and the cost of potential delays, it’s tricky getting a full picture of the total cost of shipping.

This is where Freightos.com can shine a light.

Looking for live quotes from vetted providers?

What’s included in a Freightos.com freight quote?

With quotes from a variety of logistics providers, importers can find a range of shipping options in minutes, and can opt-in to added services.

Included fees in Freightos.com quotes are:

- Main freight services

- Associated documentation and services

- Required fuel and security surcharges

- All loading, handling, and facility moving charges according to agreed transportation terms

- Pickup, delivery, and associated charges

- Accessorial services associated with pickup and delivery

- Overweight containers